Are you tired of struggling to save money? Do you find it difficult to track your progress and stay motivated? Look no further than a savings tracker. This simple tool can help you plan, monitor, and achieve your savings goals, whether you’re saving for emergencies, big purchases, or other financial objectives.

In this article, we’ll explore the benefits of using a savings tracker, how to use it effectively, and provide some tips for successful savings. So let’s dive in and start saving!

What is a Savings Tracker?

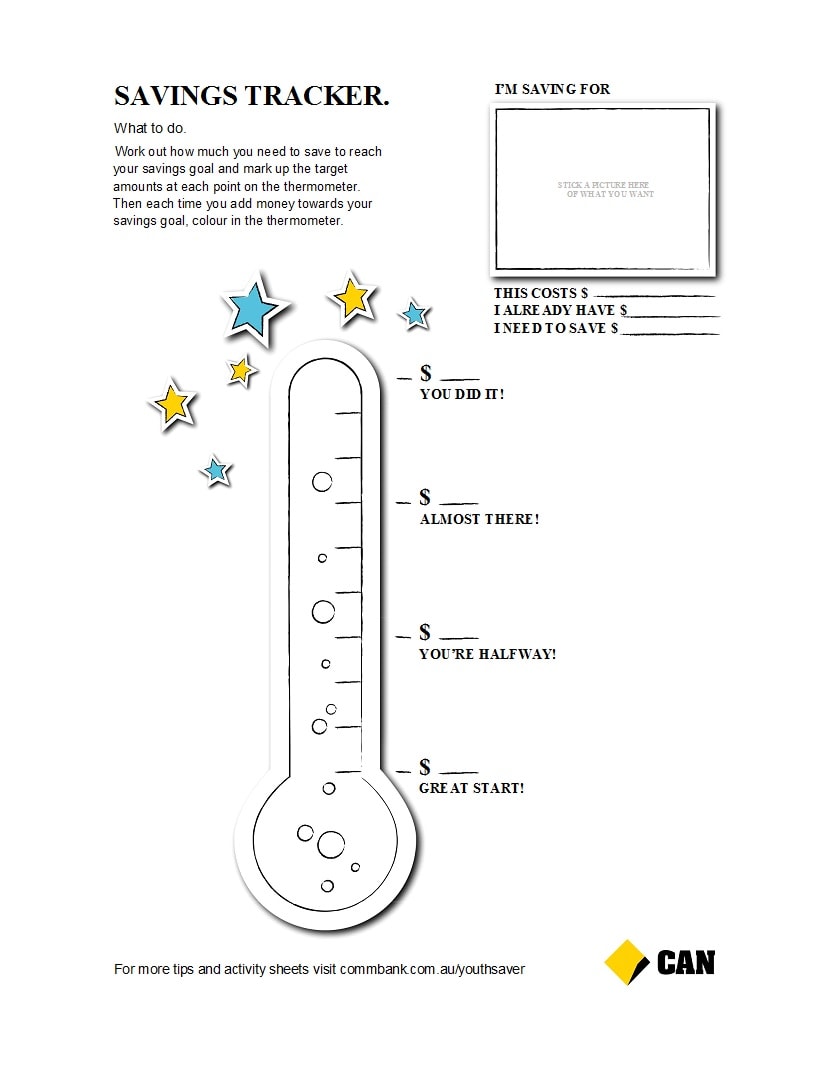

A savings tracker is a template or worksheet that helps you keep track of your savings progress. It provides a visual representation of your savings goals and allows you to monitor your progress over time.

Whether you prefer a monthly, weekly, or yearly tracker, you can find a variety of templates online that suit your needs. These trackers usually include sections to input your savings target, current balance, and any additional notes or reminders. By using a savings tracker, you can stay organized, motivated, and focused on achieving your financial goals.

![]()

Why Use a Savings Tracker?

There are several reasons why using a savings tracker can be beneficial:

- Visual representation: A savings tracker provides a visual representation of your goals, making it easier to track your progress and stay motivated.

- Organization: With a savings tracker, you can keep all your financial information in one place. This helps you stay organized and prevents any confusion or loss of important details.

- Accountability: By regularly updating your savings tracker, you hold yourself accountable for your financial goals. It creates a sense of responsibility and encourages you to make consistent progress.

- Flexibility: savings trackers come in various formats and designs, allowing you to choose one that suits your preferences. You can customize the tracker to fit your specific needs and goals.

- Motivation: Seeing your progress on paper can boost your motivation to save more. It serves as a reminder of how far you’ve come and how close you are to reaching your goals.

- Celebration: When you achieve a savings milestone, you can celebrate your success and reward yourself. A savings tracker helps you track these milestones and facilitates the celebration of your accomplishments.

How to Use a Savings Tracker

Now that you understand the benefits of a savings tracker, let’s explore how to use it effectively:

1. Set Clear Goals

Start by setting clear and specific savings goals. Determine what you’re saving for and how much you need to save. Whether it’s an emergency fund, a down payment for a house, or a dream vacation, having a specific goal in mind will help you stay focused and motivated.

2. Find the Right Tracker

Search online for savings trackers that align with your preferences. Look for templates that include sections for your savings target, current balance, and any additional notes or reminders. Find a design that you find visually appealing and easy to use.

3. Print and Customize

Once you’ve found the perfect savings tracker, print it out and customize it to fit your needs. You can add color, stickers, or any other elements that make it more visually appealing and engaging. Make it your own!

4. Update Regularly

Make it a habit to update your savings tracker regularly. This can be done weekly, monthly, or whenever you make progress towards your savings goals. By updating it consistently, you’ll have an accurate representation of your progress and can make adjustments if necessary.

5. Track Expenses

In addition to monitoring your savings, it’s essential to track your expenses. By understanding where your money is going, you can identify areas where you can cut back and save more. Use the tracker to record your expenses and analyze your spending habits.

6. Stay Motivated

Keep yourself motivated by regularly reviewing your savings tracker. Seeing your progress and how far you’ve come can help you stay focused and determined. Consider rewarding yourself when you achieve savings milestones to celebrate your success.

7. Adjust as Needed

Life is dynamic, and circumstances change. Be open to adjusting your savings goals and tracker if necessary. If you encounter unexpected expenses or changes in your financial situation, adapt your plan accordingly. Flexibility is key to successful savings.

8. Seek Support

Saving money can sometimes feel challenging, especially if you’re doing it alone. Seek support from friends, family, or online communities who share your financial goals. Share your progress, ask for advice, and celebrate milestones together. Having a support network can make the savings journey more enjoyable and rewarding.

9. Review and Reflect

Regularly review and reflect on your savings tracker. Take note of any patterns, challenges, or successes. Use this information to make informed decisions and adjustments to your savings strategy. Continuous improvement is key to achieving your financial goals.

10. Stay Consistent

Consistency is crucial when it comes to saving money. Make saving a habit and prioritize it in your daily life. Even small amounts saved regularly can add up over time. Stay consistent, and you’ll be amazed at how much you can achieve.

Examples

![]()

savings tracker 02

Tips for Successful Savings

Here are some additional tips to help you succeed in your savings journey:

- Automate your savings: Set up automatic transfers from your paycheck to your savings account. This ensures consistent savings without the temptation to spend the money elsewhere.

- Create a budget: Track your income and expenses to identify areas where you can cut back and save more. A budget helps you stay on track and make informed financial decisions.

- Reduce unnecessary expenses: Evaluate your spending habits and identify any unnecessary expenses. Cut back on non-essential items to free up more money for savings.

- Save windfalls: Whenever you receive unexpected money, such as tax refunds or bonuses, resist the urge to splurge. Instead, save it for your goals.

- Stay motivated: Find ways to stay motivated on your savings journey. Whether it’s visualizing your goals, rewarding yourself for milestones, or seeking support from others, keep your motivation high.

- Track your progress: Regularly review your savings tracker and assess your progress. Celebrate milestones and make adjustments as needed.

- Stay focused: Avoid impulsive spending and stay focused on your long-term financial goals. Remind yourself of the benefits of saving and the future financial security it will bring.

- Invest wisely: Once you have built up your emergency fund, consider investing your savings to earn passive income and grow your wealth.

By implementing these tips and utilizing a savings tracker, you’ll be well on your way to achieving your financial goals and enjoying the peace of mind that comes with financial security.

Savings Tracker Template – Download