Creating an annual budget template is essential for individuals, businesses, and organizations to plan their finances effectively. A budget serves as a roadmap for managing income and expenses throughout the year, helping to track where money is being spent and identify areas for potential savings or increased investment. By having a clear budget in place, you can make informed decisions to achieve your financial goals and avoid unnecessary debt or financial hardship.

What is an Annual Budget Template?

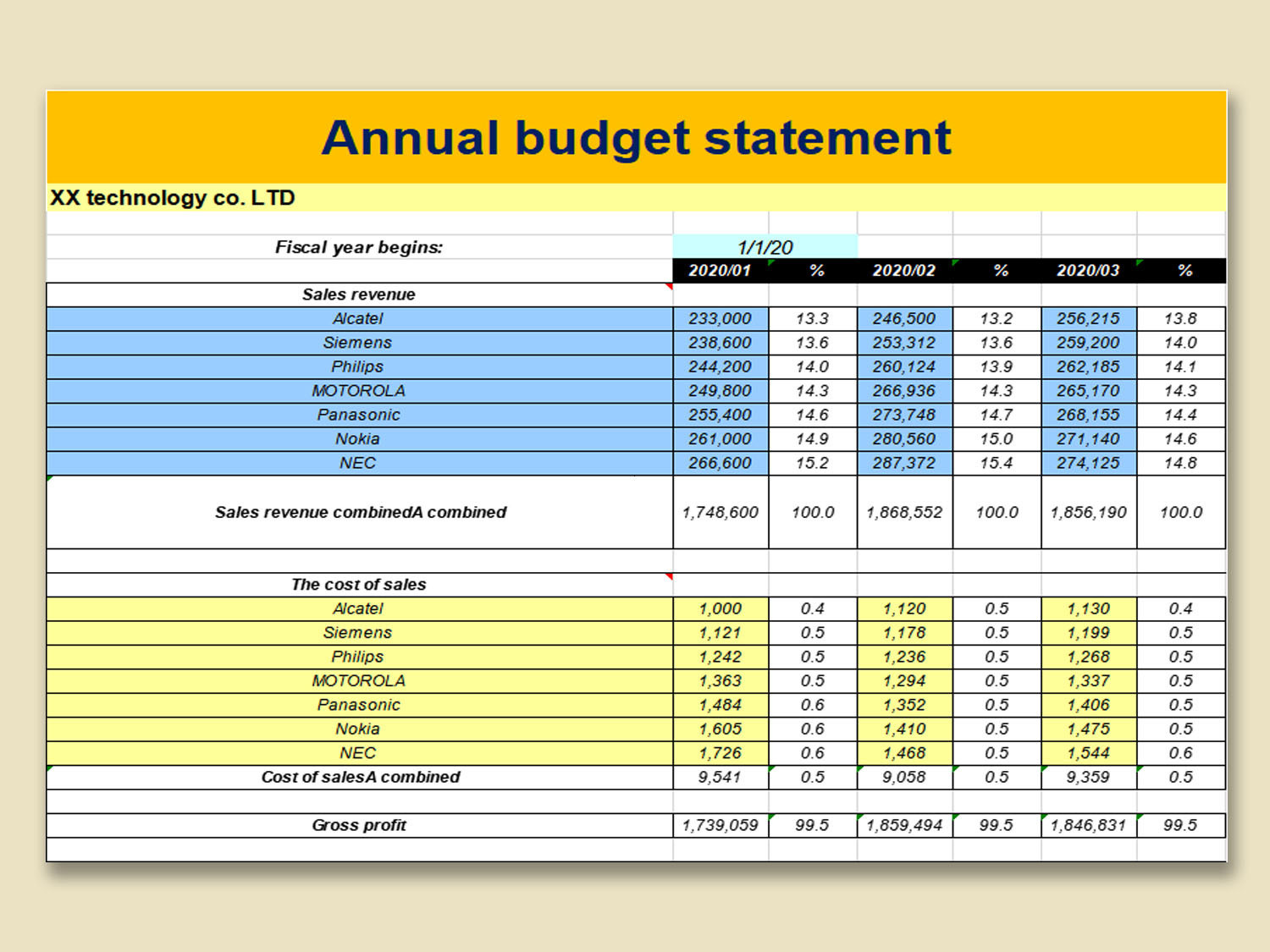

An annual budget template is a structured document that outlines projected income, expenses, and savings for the upcoming year. It typically includes categories such as housing, transportation, groceries, entertainment, savings, and debt repayment, among others. The template serves as a tool to estimate how much money will be coming in and going out each month, allowing you to allocate funds accordingly and monitor your financial health.

The Purpose of an Annual Budget Template

Image Source: vecteezy.com

The primary purpose of an annual budget template is to provide a clear overview of your financial situation and help you make informed decisions about how to manage your money. By setting financial goals and creating a budget that aligns with those goals, you can prioritize spending, identify areas for improvement, and track your progress over time. Additionally, a budget can help you anticipate and prepare for any unexpected expenses that may arise throughout the year.

Why You Need an Annual Budget Template

Having an annual budget template is crucial for achieving financial stability and success. Without a budget, it can be easy to overspend, accumulate debt, and struggle to make ends meet. A budget helps you take control of your finances, avoid living paycheck to paycheck, and work towards building wealth for the future. By planning ahead and sticking to a budget, you can make strategic decisions about how to use your money and achieve your financial goals.

How to Create an Annual Budget Template

Image Source: wpscdn.com

Creating an annual budget template involves several steps to ensure accuracy and effectiveness. Start by gathering your financial records, including bank statements, pay stubs, bills, and receipts. Next, list all sources of income and categorize your expenses into fixed costs (such as rent or mortgage) and variable costs (such as groceries or entertainment). Allocate funds to each category based on your priorities and financial goals, making sure to account for savings and debt repayment. Finally, monitor your budget regularly and make adjustments as needed to stay on track.

Tips for Successful Budgeting

Set realistic goals: Make sure your budget aligns with your financial goals and priorities.

Track your spending: Keep a record of all your expenses to identify patterns and areas for improvement.

Review and adjust: Regularly review your budget and make adjustments as needed to stay on track.

Plan for the unexpected: Include a buffer in your budget for any unexpected expenses that may arise.

Stay disciplined: Stick to your budget and avoid unnecessary spending to achieve your financial goals.

Seek professional help: Consider consulting with a financial advisor for personalized guidance and support.

Image Source: etsystatic.com

Image Source: smartsheet.com

Image Source: projectmanager.com

Image Source: smartsheet.com

Image Source: generalblue.com

Image Source: etsystatic.com

Image Source: etsystatic.com

Image Source: smartsheet.com