Creating and sticking to a personal monthly budget can be a daunting task for many individuals. It requires discipline, organization, and a clear understanding of your financial goals. One helpful tool that can assist in this process is a personal monthly budget template. This template serves as a guide to help you track your income, expenses, and savings goals, ensuring that you stay on track with your financial objectives.

What is a Personal Monthly Budget Template?

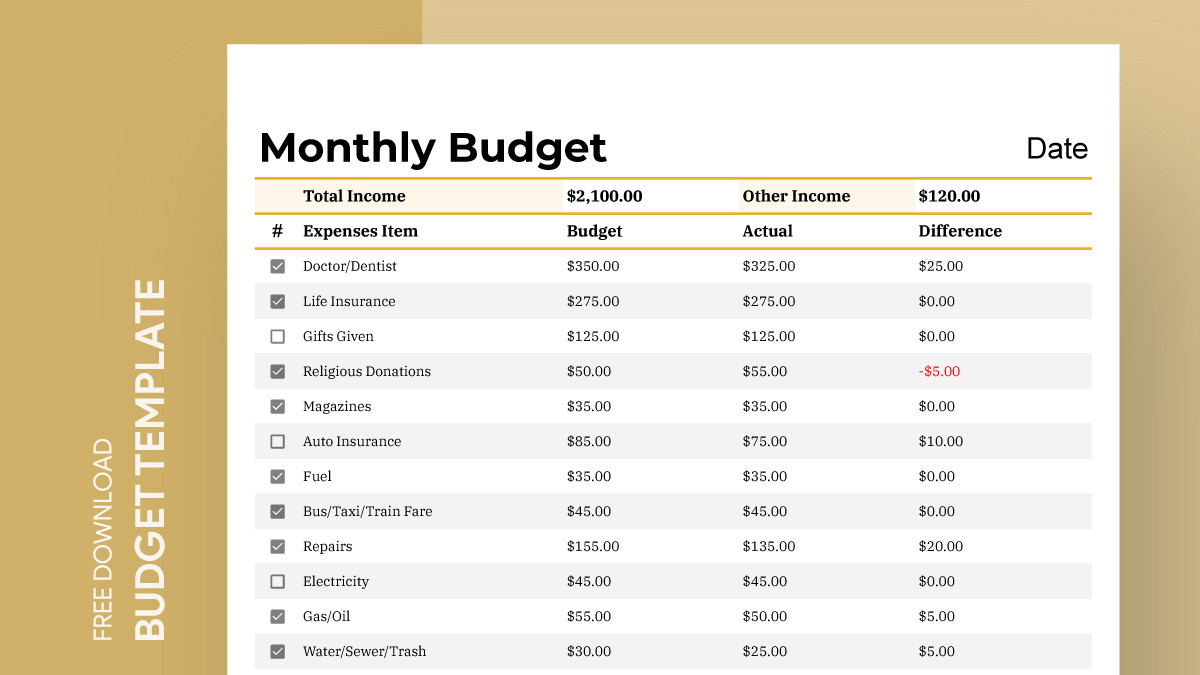

A personal monthly budget template is a pre-designed spreadsheet or document that helps individuals manage their finances on a monthly basis. It typically includes categories for income, expenses, and savings, allowing you to input your financial information and track your progress throughout the month. These templates can be customized to fit your specific financial situation and goals, making them a valuable tool for anyone looking to take control of their finances.

The Purpose of Using a Personal Monthly Budget Template

Image Source: wpscdn.com

The primary purpose of using a personal monthly budget template is to gain a clear understanding of your financial situation and make informed decisions about your money. By tracking your income and expenses each month, you can identify where your money is going, make adjustments as needed, and work towards achieving your financial goals. Whether you are saving for a big purchase, paying off debt, or simply trying to live within your means, a monthly budget template can help you stay on track and avoid financial pitfalls.

Why You Should Use a Personal Monthly Budget Template

There are several reasons why using a personal monthly budget template is beneficial. First and foremost, it provides a visual representation of your finances, making it easier to see where your money is going and where you can make improvements. Additionally, a budget template can help you set realistic financial goals, track your progress over time, and make adjustments as needed. By using a budget template, you can take control of your finances, reduce financial stress, and work towards a more secure financial future.

How to Use a Personal Monthly Budget Template

Image Source: smartsheet.com

Using a personal monthly budget template is relatively straightforward. Start by listing all sources of income for the month, including wages, bonuses, and any other sources of income. Next, categorize your expenses into fixed expenses (such as rent or mortgage payments) and variable expenses (such as groceries or entertainment). Input these amounts into the appropriate categories on the budget template. Finally, subtract your total expenses from your total income to determine your monthly savings or deficit. Use this information to make adjustments to your spending as needed.

Tips for Successful Budgeting

1. Track Your Spending

Image Source: gdoc.io

Keep track of every penny you spend throughout the month, including small purchases. This will help you identify areas where you can cut back and save money.

2. Set Realistic Goals

Image Source: gdoc.io

Be realistic about your financial goals and make sure they are achievable within your budget. Setting unattainable goals can lead to frustration and failure.

3. Review Your Budget Regularly

Image Source: smartsheet.com

Take time each month to review your budget and make adjustments as needed. Life circumstances change, so your budget should be flexible to accommodate these changes.

4. Build an Emergency Fund

Image Source: etsystatic.com

Set aside money each month for unexpected expenses or emergencies. Having an emergency fund can prevent you from going into debt when unforeseen expenses arise.

5. Automate Your Savings

Set up automatic transfers to your savings account each month. This will help you save consistently and prevent you from spending money earmarked for savings.

6. Avoid Impulse Purchases

Avoid making impulse purchases by creating a list before shopping and sticking to it. This will help you stay within your budget and avoid unnecessary spending.

7. Reward Yourself

Reward yourself for sticking to your budget and reaching your financial goals. Celebrate small victories to stay motivated and on track with your budgeting efforts.

8. Seek Professional Help if Needed

If you are struggling to create or stick to a budget, don’t hesitate to seek help from a financial advisor or counselor. They can provide guidance and support to help you achieve your financial goals.