Budgeting is an essential aspect of managing personal finances. It allows individuals to track their expenses, prioritize their spending, and save for future goals. One popular method of budgeting is the 2 person budget template, designed specifically for couples or two individuals sharing expenses. This template helps partners or roommates allocate funds for joint expenses while also maintaining separate budgets for personal spending.

What is a 2 Person Budget Template?

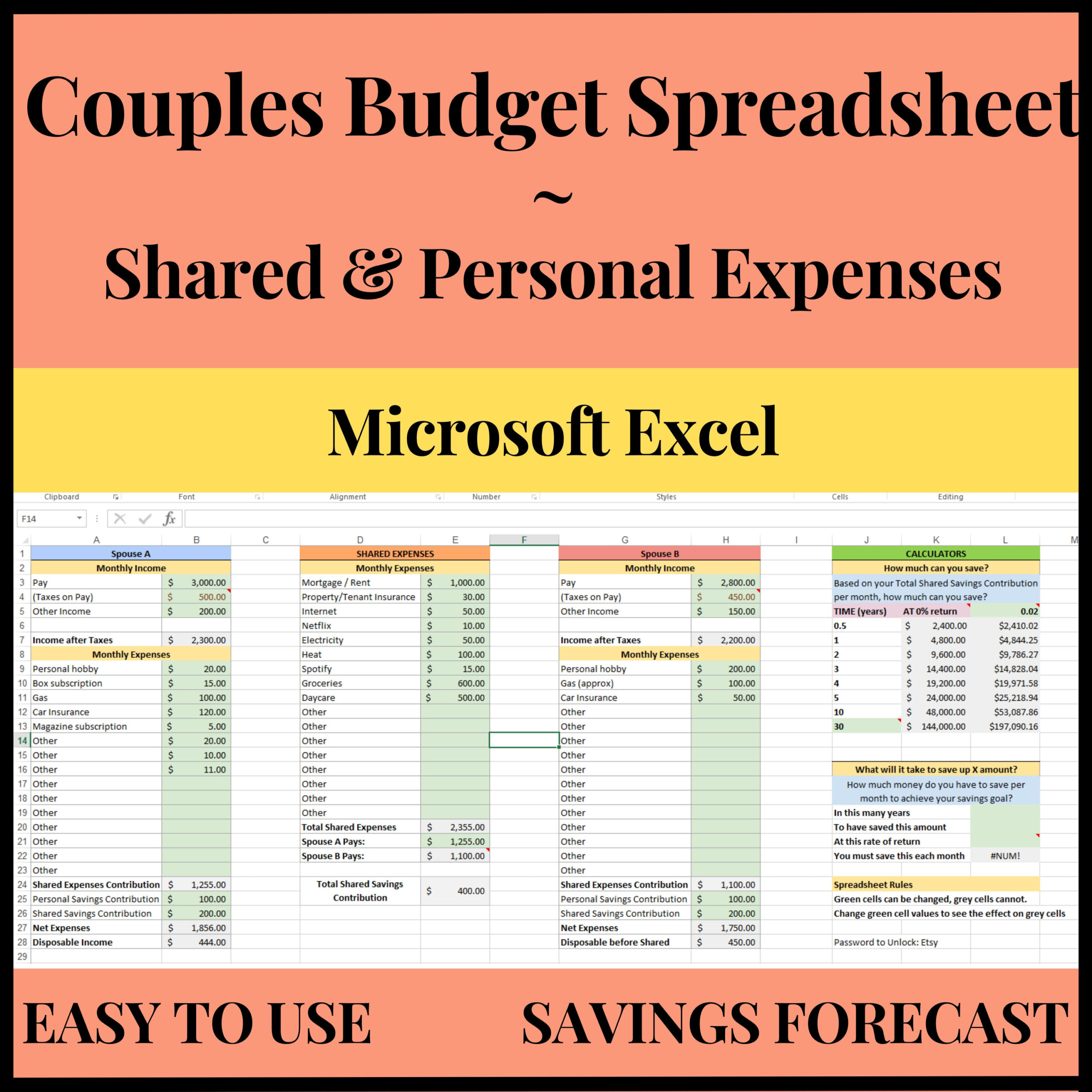

A 2 person budget template is a financial planning tool that allows couples or roommates to manage their shared expenses and individual finances effectively. This template typically includes sections for joint expenses such as rent, utilities, groceries, and entertainment, as well as separate categories for personal expenses like clothing, hobbies, and personal care. By using a 2 person budget template, partners can allocate funds based on their income levels and financial goals, ensuring that both parties are on the same page when it comes to money management.

The Purpose of a 2 Person Budget Template

Image Source: wordpress.com

The primary purpose of a 2 person budget template is to help couples or roommates work together to achieve their financial goals. By creating a shared budget, individuals can track their spending, identify areas where they can save money, and plan for future expenses such as vacations or major purchases. Additionally, a 2 person budget template can help partners communicate openly about their financial priorities and make joint decisions about money management. Ultimately, the goal of using a 2 person budget template is to promote financial harmony and stability within the relationship.

Why You Should Use a 2 Person Budget Template

There are several benefits to using a 2 person budget template, especially for couples or roommates sharing expenses. Firstly, a budget template provides a clear overview of your financial situation, allowing you to see where your money is going and make adjustments as needed. Secondly, a 2 person budget template encourages communication and collaboration between partners, fostering a sense of teamwork when it comes to money management. Finally, by using a budget template, you can set specific financial goals and track your progress over time, ensuring that you are working towards a secure financial future together.

How to Create a 2 Person Budget Template

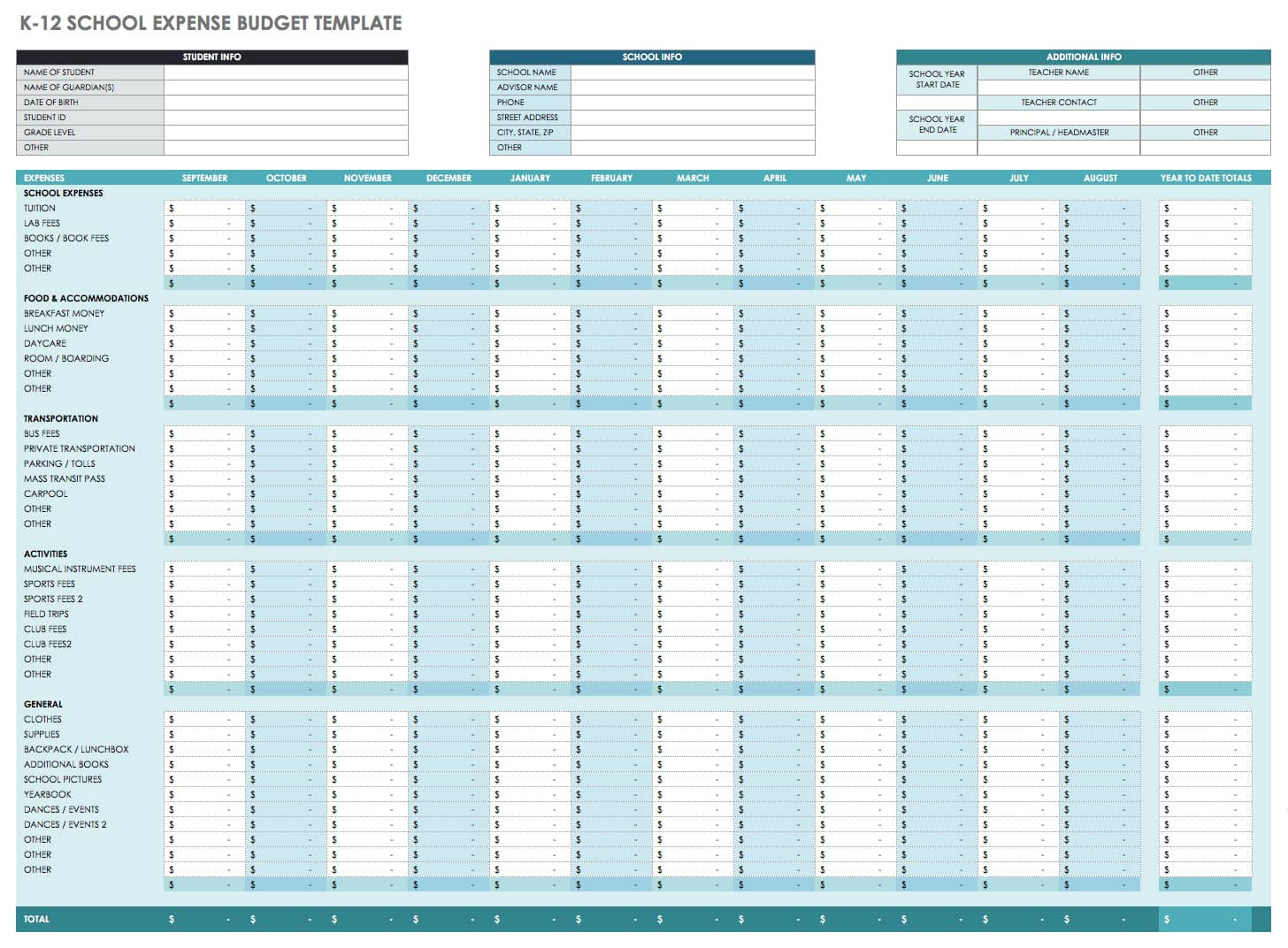

Image Source: canva.com

Creating a 2 person budget template is a relatively simple process that can be customized to fit your unique financial situation. To start, gather information about your joint expenses, individual incomes, and financial goals. Next, create a spreadsheet or use a budgeting app to organize your expenses into categories such as housing, utilities, transportation, and entertainment. Allocate funds to each category based on your income levels and prioritize your spending accordingly. Finally, review your budget regularly and make adjustments as needed to ensure that you are staying on track with your financial goals.

Tips for Successful Budgeting as a Couple

1. Communicate Openly: Make sure to have regular discussions about your finances, including your income, expenses, and financial goals. Transparency is key to successful budgeting as a couple.

Image Source: smartsheet.com

2. Set Clear Goals: Determine what you are saving for as a couple, whether it’s a vacation, a new home, or retirement. Having specific goals can help you stay motivated and focused on your budget.

3. Track Your Spending: Keep a close eye on your expenses and make adjustments as needed to stay within your budget. Consider using a budgeting app to make tracking easier.

Image Source: pinimg.com

4. Celebrate Your Wins: Acknowledge your financial milestones and celebrate your progress together. Whether it’s paying off a debt or reaching a savings goal, take the time to recognize your achievements as a couple.

5. Be Flexible: Life happens, and unexpected expenses may come up. Be prepared to adjust your budget as needed and make compromises when necessary to stay on track with your financial goals.

Image Source: generalblue.com

6. Plan for the Future: Consider setting aside funds for emergencies, investments, and retirement. Planning for the future together can provide peace of mind and ensure long-term financial security.

7. Seek Professional Advice: If you are struggling to create or stick to a budget, consider seeking the help of a financial advisor. A professional can provide personalized guidance and support to help you achieve your financial goals as a couple.

Image Source: medium.com

8. Practice Patience: Building a strong financial foundation takes time, so be patient with yourselves and each other as you work towards your shared goals. Remember that budgeting is a journey, and it’s okay to make mistakes along the way as long as you learn from them and continue to grow together.

Image Source: thesavvymama.com

Image Source: etsystatic.com

Image Source: medium.com