Buying a vehicle is an exciting but significant financial decision. Whether you’re purchasing a car, truck, or motorcycle, understanding the financial implications is crucial. One essential aspect to consider is your monthly payments.

Vehicle mortgage payment calculators, also known as car loan EMI calculators, can help you estimate your monthly payments and plan your budget effectively. Additionally, these calculators enable you to compare different financing options and make informed financial decisions.

In this article, we’ll explore what a vehicle mortgage payment calculator is, why it’s beneficial, how to use it, and provide examples and tips for successful budget planning.

What is a Vehicle Mortgage Payment Calculator?

A vehicle mortgage payment calculator is an online tool that helps individuals estimate their monthly payments for a car loan or vehicle mortgage. This calculator takes into account factors such as the loan amount, interest rate, loan term, and down payment to provide an accurate estimate of the monthly payment amount. By inputting these details into the calculator, you can quickly determine how much you’ll need to pay each month for your vehicle loan.

These calculators are designed to simplify the process of budgeting for your vehicle purchase. Instead of manually calculating the monthly payments based on complex formulas, you can rely on the calculator to do the math for you. This saves time and ensures accuracy in your budget planning.

Why Use a Vehicle Mortgage Payment Calculator?

Using a vehicle mortgage payment calculator offers several benefits for individuals looking to finance their vehicle purchase:

- Estimate Monthly Payments: The primary purpose of the calculator is to help you estimate your monthly payments accurately. By inputting the loan details, you’ll get an instant calculation of the expected monthly payment amount. This allows you to plan your budget accordingly and determine if the payment is affordable within your financial means.

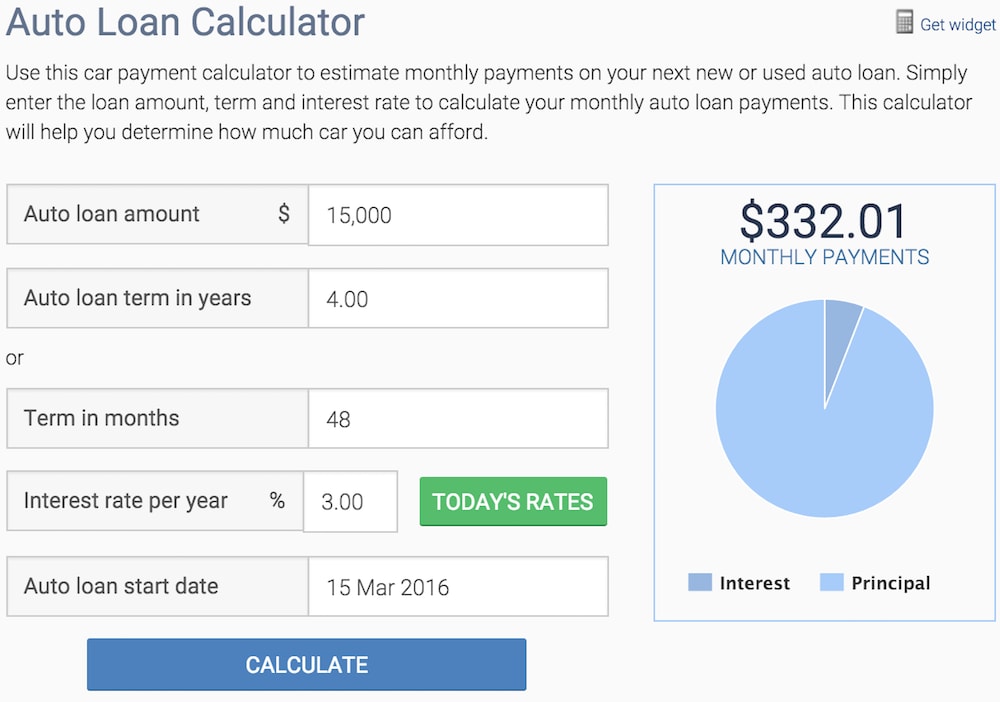

- Compare Different Options: With a vehicle mortgage payment calculator, you can easily compare different financing options. By adjusting the loan amount, interest rate, and loan term, you can see how each variable affects the monthly payment. This allows you to explore various scenarios and choose the option that best suits your budget and financial goals.

- Informed Financial Decisions: Making informed financial decisions is crucial when financing a vehicle. A vehicle mortgage payment calculator empowers you to understand the financial implications of your loan. By seeing the monthly payment amount, you can evaluate if it aligns with your income and other financial obligations. This knowledge enables you to make well-informed decisions that won’t strain your budget.

How to Use a Vehicle Mortgage Payment Calculator?

Using a vehicle mortgage payment calculator is a straightforward process. Here’s a step-by-step guide to help you get started:

1. Gather Loan Details:

Before using the calculator, gather all the necessary loan details. This includes the loan amount, interest rate, loan term, and down payment. Having this information readily available will make the calculation process smoother.

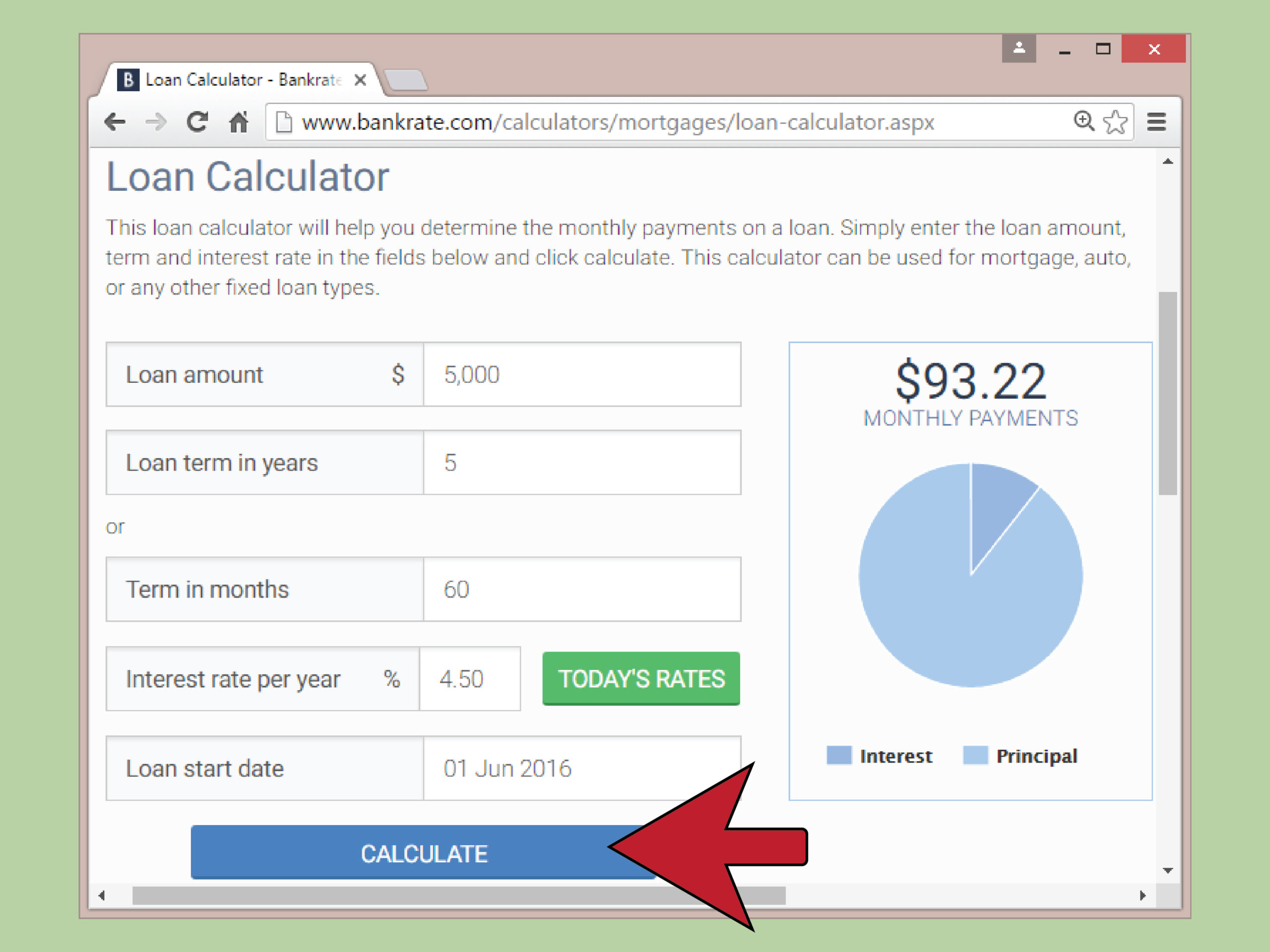

2. Access an Online Calculator:

Search for a reliable online vehicle mortgage payment calculator. Many financial institutions, automotive websites, and independent financial websites offer these calculators for free. Make sure to choose a trusted source to ensure accurate results.

3. Input Loan Details:

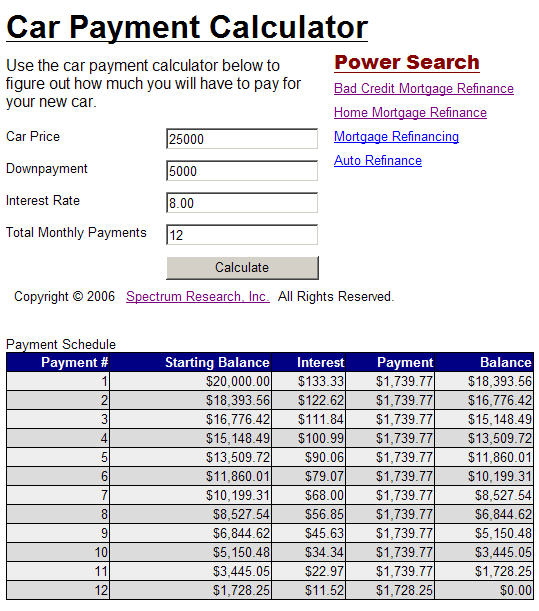

Using the calculator, input the loan details you gathered in step 1. Enter the loan amount, interest rate, loan term, and down payment into the designated fields. Some calculators may ask for additional information, such as taxes and fees. Fill in all the required fields to ensure accurate calculations.

4. Calculate:

Once you’ve entered all the necessary loan details, click on the “Calculate” or “Estimate” button. The calculator will process the information and provide you with the estimated monthly payment amount. Take note of this amount for budget planning purposes.

5. Explore Different Scenarios:

To compare different financing options, you can adjust the loan details within the calculator. For example, you can increase or decrease the loan amount, adjust the interest rate, or change the loan term. By doing so, you can see how these changes impact the monthly payment amount. This allows you to make an informed decision based on your budget and financial goals.

6. Consider Additional Costs:

While the vehicle mortgage payment calculator provides an estimate of your monthly payments, it’s essential to consider additional costs. These may include insurance, maintenance, fuel, and registration fees. By factoring in these expenses, you can have a more comprehensive understanding of the total cost of owning a vehicle beyond just the monthly payment.

7. Consult with a Financial Advisor:

If you’re unsure about the calculations or have complex financial circumstances, it’s advisable to consult with a financial advisor. They can provide personalized guidance based on your specific situation and help you make the best financial decision regarding your vehicle purchase.

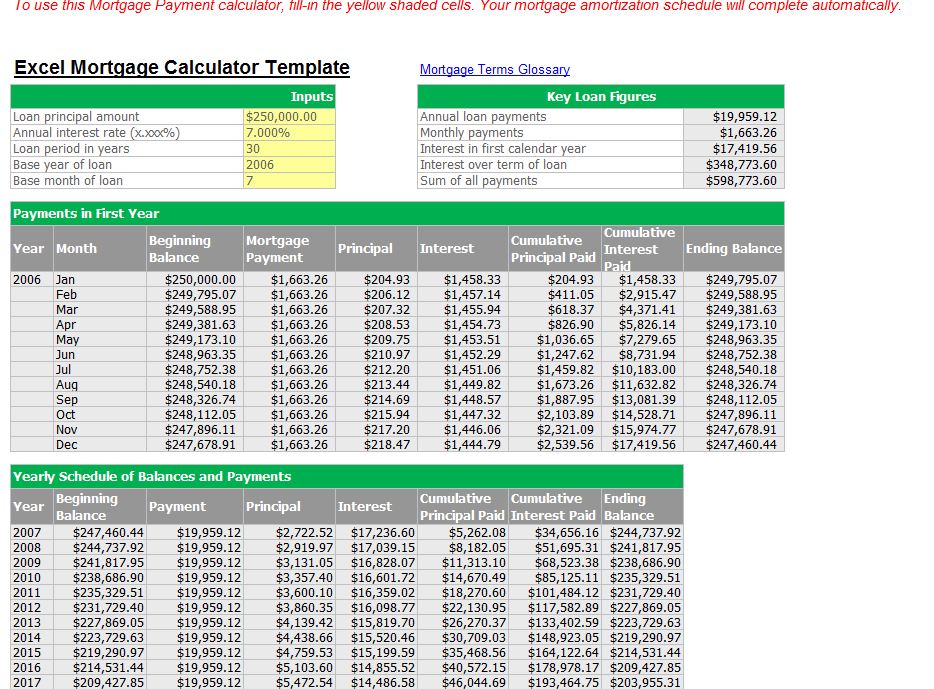

Example

Tips for Successful Budget Planning

When using a vehicle mortgage payment calculator and planning your budget, consider the following tips:

- Be Realistic: Ensure that the monthly payment is realistic and fits within your budget. Avoid stretching your finances too thin by opting for a lower monthly payment that allows for other essential expenses.

- Consider Your Income Stability: If your income is variable or uncertain, it’s advisable to choose a monthly payment that you can comfortably afford even during lean months.

- Plan for Unexpected Expenses: Vehicles come with potential unexpected expenses, such as repairs or maintenance. Allocate a portion of your budget for these unforeseen costs to avoid financial strain.

- Explore Various Lenders: Different lenders offer different interest rates and loan terms. Shop around and compare offers from multiple lenders to secure the most favorable financing option.

- Factor in Trade-Ins or Rebates: If you’re trading in an existing vehicle or eligible for rebates, consider how these factors may impact your loan amount and monthly payment. These can help reduce the overall cost of your vehicle purchase.

- Consider Prepayment Options: Some loans allow for prepayment or early repayment without penalties. If you anticipate having extra funds in the future, explore loans with prepayment options to potentially save on interest costs.

- Review Your Budget Regularly: As your financial circumstances may change over time, regularly review your budget to ensure it aligns with your current income and expenses. Adjustments may be necessary to maintain financial stability.

- Seek Professional Advice: If you’re uncertain about any aspect of your vehicle purchase or loan, seek advice from professionals such as financial advisors or loan officers. They can provide guidance tailored to your specific situation.

Conclusion

A vehicle mortgage payment calculator, also known as a car loan EMI calculator, is a valuable tool for anyone planning to finance their vehicle purchase. By using this calculator, you can estimate your monthly payments, compare different financing options, and make informed financial decisions.

Remember to gather all the necessary loan details, explore various scenarios, and consider additional costs beyond just the monthly payment. By following these steps and tips for successful budget planning, you’ll be well-prepared to embark on your vehicle purchase journey with confidence.

Vehicle Mortgage Payment Calculator Template – Download