Are you looking for a way to effectively manage your finances and keep track of your expenses? Using a bi-weekly budget template can be a game-changer. This tool allows you to plan your spending, monitor your income, and stay on top of your financial goals. Whether you are trying to save money, pay off debt, or simply want to have a better understanding of where your money is going, a bi-weekly budget template can help you achieve financial success.

What is a Bi-Weekly Budget Template?

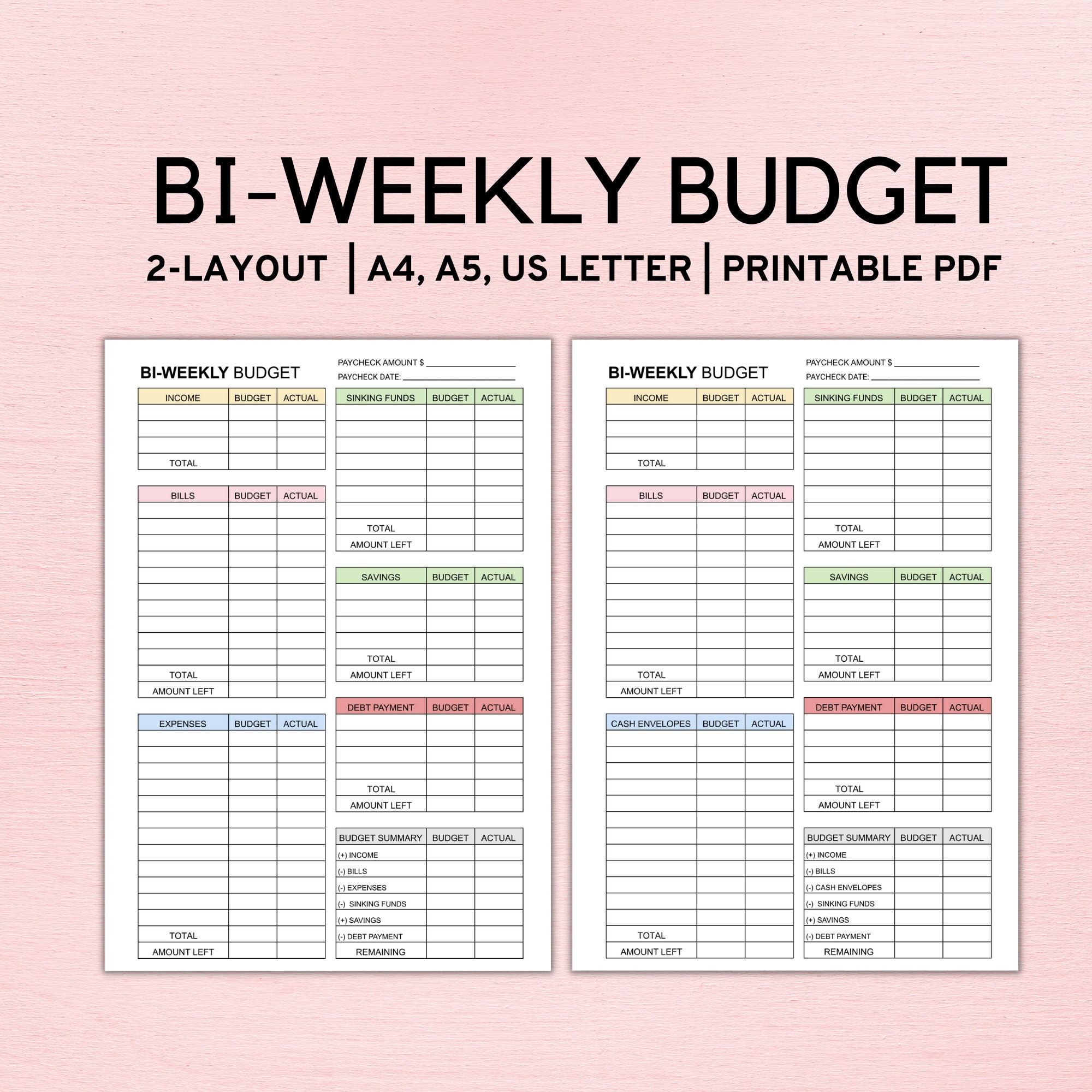

A bi-weekly budget template is a pre-designed spreadsheet or document that helps you allocate your income towards various expenses over a two-week period. It typically includes sections for income, fixed expenses, variable expenses, savings, and debt payments. By inputting your financial information into the template, you can get a clear picture of your financial situation and make informed decisions about your spending.

The Purpose of Using a Bi-Weekly Budget Template

Image Source: notability.com

The primary purpose of using a bi-weekly budget template is to take control of your finances and achieve your financial goals. By creating a detailed budget, you can track your spending, identify areas where you can cut back, and allocate more money towards savings or debt repayment. The template serves as a roadmap for your financial journey, helping you stay organized and disciplined with your money.

Why Use a Bi-Weekly Budget Template?

Using a bi-weekly budget template offers several benefits. First and foremost, it provides clarity on where your money is going. By categorizing your expenses and income, you can see exactly how much you are spending on essentials, discretionary purchases, and savings. This visibility allows you to make adjustments as needed and prioritize your financial goals. Additionally, a budget template helps you avoid overspending and impulsive purchases, leading to better financial habits and long-term stability.

How to Create and Use a Bi-Weekly Budget Template

Image Source: myminimalplanner.com

Creating a bi-weekly budget template is simple. Start by listing all your sources of income for the two-week period, including your paycheck, side hustle earnings, or any other additional income. Next, categorize your expenses into fixed (rent, utilities, insurance) and variable (groceries, dining out, entertainment). Allocate a specific amount for savings and debt payments. Finally, track your spending throughout the two weeks and adjust as needed.

1. Determine your financial goals and priorities.

Before creating your budget template, identify what you want to achieve financially. Whether it’s building an emergency fund, saving for a vacation, or paying off debt, having clear goals will give your budget purpose and direction.

2. Be realistic with your budget categories and amounts.

Image Source: mrsneat.net

When setting up your budget template, make sure your income and expenses are realistic. Be honest about your spending habits and allocate enough money for essentials while leaving room for discretionary purchases.

3. Track your spending regularly.

To ensure the effectiveness of your budget template, track your spending regularly. Review your expenses, compare them to your budgeted amounts, and make adjustments as needed. This practice will help you stay on track and make informed financial decisions.

4. Make adjustments as needed.

Image Source: generalblue.com

Life is unpredictable, and your financial situation may change. Be prepared to make adjustments to your budget template as needed. If you overspend in one category, cut back in another to stay within your overall budget.

5. Celebrate your financial wins.

As you stick to your bi-weekly budget template and make progress towards your financial goals, celebrate your achievements. Whether it’s reaching a savings milestone or paying off a credit card, acknowledging your successes will motivate you to continue on your financial journey.

6. Seek help if needed.

Image Source: etsystatic.com

If you are struggling to create or stick to your budget template, don’t be afraid to seek help. There are financial advisors, budgeting apps, and online resources available to support you in managing your finances effectively. Remember, it’s okay to ask for help when needed.

7. Stay consistent and disciplined.

Consistency and discipline are key to the success of your bi-weekly budget template. Make budgeting a habit, review your finances regularly, and stay committed to your financial goals. With time and effort, you will see the positive impact of budgeting on your financial well-being.

8. Reflect and adjust for the future.

Image Source: etsystatic.com

At the end of each two-week period, take time to reflect on your budget template’s effectiveness. Identify areas of improvement, celebrate your successes, and adjust your budget for the upcoming period. By continuously evaluating and refining your budgeting process, you can achieve long-term financial stability and success.

Tips for Successful Budgeting with a Bi-Weekly Budget Template

Track your expenses diligently. Keep a record of every purchase and expense to stay on top of your spending.

Review your budget regularly. Check in on your budget template weekly to ensure you are on track with your financial goals.

Be flexible when needed. Life happens, and unexpected expenses may arise. Be prepared to adjust your budget accordingly.

Communicate with your family or household members. If you share finances with others, communicate openly about your budgeting goals and collaborate on financial decisions.

Reward yourself for sticking to your budget. Treat yourself to a small reward for meeting your budgeting milestones to stay motivated and engaged.

Seek financial education and resources. Educate yourself on personal finance topics and utilize resources to enhance your budgeting skills and knowledge.

Image Source: etsystatic.com