Are you struggling to keep track of your finances with your bi-weekly pay schedule? Do you find it challenging to budget effectively when you receive your paycheck every two weeks? If so, you’re not alone. Many people face this same issue and can benefit from using a bi-weekly pay budget template to help them manage their money more efficiently.

What is a Bi-Weekly Pay Budget Template?

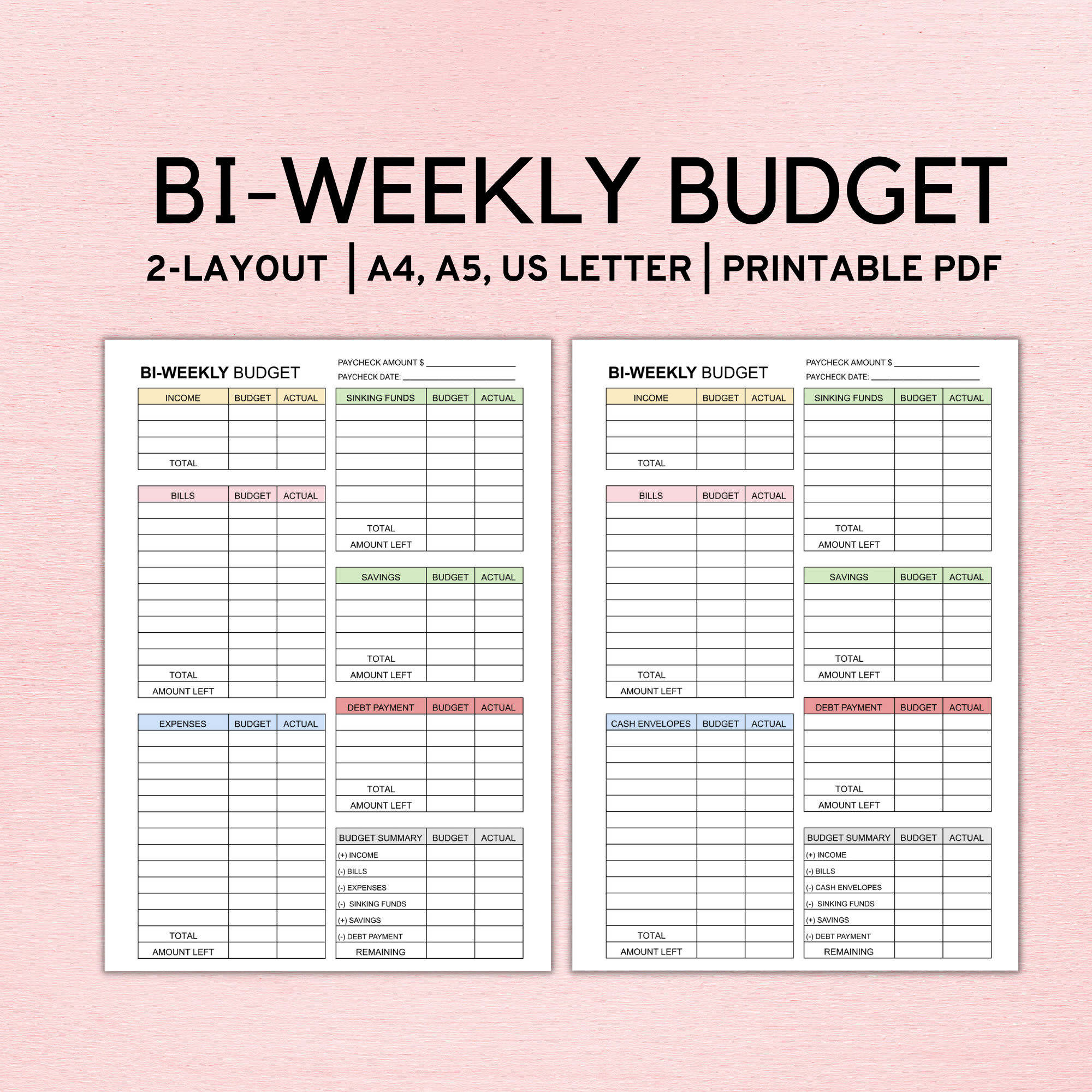

A bi-weekly pay budget template is a tool that helps individuals plan and organize their finances based on a bi-weekly pay schedule. This template typically includes sections for income, expenses, savings, and financial goals. By using a bi-weekly pay budget template, you can track where your money is going, identify areas where you can cut back, and set aside funds for future expenses.

The Purpose of Using a Bi-Weekly Pay Budget Template

Image Source: etsystatic.com

The primary purpose of using a bi-weekly pay budget template is to gain better control over your finances. With a clear overview of your income and expenses, you can make informed decisions about how to allocate your money. By setting up a budget and sticking to it, you can avoid overspending, build up your savings, and work towards achieving your financial goals.

Why You Should Use a Bi-Weekly Pay Budget Template

Using a bi-weekly pay budget template can provide numerous benefits, including:

– Improved financial awareness: By tracking your income and expenses, you can gain a better understanding of your financial situation.

– Better money management: With a budget in place, you can make smarter choices about how to spend your money.

– Enhanced savings: By setting aside funds for savings and emergencies, you can build a financial cushion for the future.

– Goal setting: A budget template can help you set and prioritize financial goals, such as paying off debt, buying a home, or saving for retirement.

How to Create a Bi-Weekly Pay Budget Template

Image Source: mintnotion.com

Creating a bi-weekly pay budget template is a straightforward process. Here are some steps to help you get started:

1. List your sources of income: Begin by listing all sources of income you receive on a bi-weekly basis.

2. Record your expenses: Make a detailed list of all your regular monthly expenses, such as rent, utilities, groceries, and transportation.

3. Set savings goals: Determine how much you want to save each pay period and allocate funds towards your savings goals.

4. Track your spending: Monitor your spending throughout the pay period and adjust your budget as needed to stay on track.

5. Review and adjust: At the end of each pay period, review your budget, assess your progress towards your goals, and make any necessary adjustments for the next period.

Tips for Successful Budgeting with a Bi-Weekly Pay Budget Template

Managing your finances with a bi-weekly pay budget template can be challenging, but with the right strategies, you can make it a successful endeavor. Here are some tips to help you budget effectively:

Image Source: notability.com

Track your expenses: Keep a record of all your expenses to ensure you stay within your budget.

Automate your savings: Set up automatic transfers to your savings account to make saving easier.

Be flexible: Life happens, so be prepared to adjust your budget as needed to accommodate unexpected expenses.

Seek support: Consider working with a financial advisor or accountability partner to help you stay on track with your budget.

Celebrate milestones: Acknowledge your progress and celebrate reaching financial milestones to stay motivated on your budgeting journey.

Review regularly: Schedule regular check-ins to review your budget, assess your progress, and make any necessary adjustments.

In conclusion, using a bi-weekly pay budget template can be a game-changer for your finances. By taking control of your money, setting clear goals, and tracking your progress, you can achieve financial stability and peace of mind. Start budgeting with a bi-weekly pay budget template today and pave the way towards a more secure financial future.

Image Source: etsystatic.com

Image Source: i2.wp.com

Image Source: generalblue.com

Image Source: etsystatic.com

Image Source: etsystatic.com