In the world of business transactions, a bill of sale is a crucial document that serves as proof of a transfer of ownership of a business entity from one party to another. This legal document outlines the specifics of the sale, including the names of the buyer and seller, the purchase price, and any terms and conditions of the sale. A Business Entity Bill of Sale Form is a specialized version of this document tailored specifically for the sale of a business entity, such as a corporation, partnership, or limited liability company.

What is a Business Entity Bill of Sale Form?

A Business Entity Bill of Sale Form is a legal document that records the sale of a business entity from one party to another. This form typically includes detailed information about the business being sold, such as its name, structure, assets, liabilities, and any other relevant details. It also outlines the terms of the sale, including the purchase price, payment method, and any conditions that must be met for the sale to be completed.

The Purpose of a Business Entity Bill of Sale Form

Image Source: lawrina.org

The primary purpose of a Business Entity Bill of Sale Form is to provide a clear record of the sale of a business entity. By documenting the details of the transaction in writing, both the buyer and seller can have a clear understanding of their rights and responsibilities. This document can also serve as proof of ownership transfer, which can be important for legal and tax purposes.

Why Use a Business Entity Bill of Sale Form?

Using a Business Entity Bill of Sale Form is essential for both the buyer and seller to protect their interests in the transaction. By putting the terms of the sale in writing, both parties can avoid misunderstandings or disputes down the line. This document can also be crucial in the event of a legal dispute or audit, as it provides a clear record of the transaction.

How to Create a Business Entity Bill of Sale Form

Image Source: cocosign.com

Creating a Business Entity Bill of Sale Form can be a complex process, as it requires detailed information about the business being sold. To create this document, you should start by gathering all relevant information about the business, including its assets, liabilities, and any other details that may be relevant to the sale. You can then use a template or hire a lawyer to help you draft the form, ensuring that all necessary details are included.

1. Gather Information

Before creating a Business Entity Bill of Sale Form, gather all relevant information about the business being sold, including its assets, liabilities, and any other details that may be relevant to the sale.

2. Use a Template

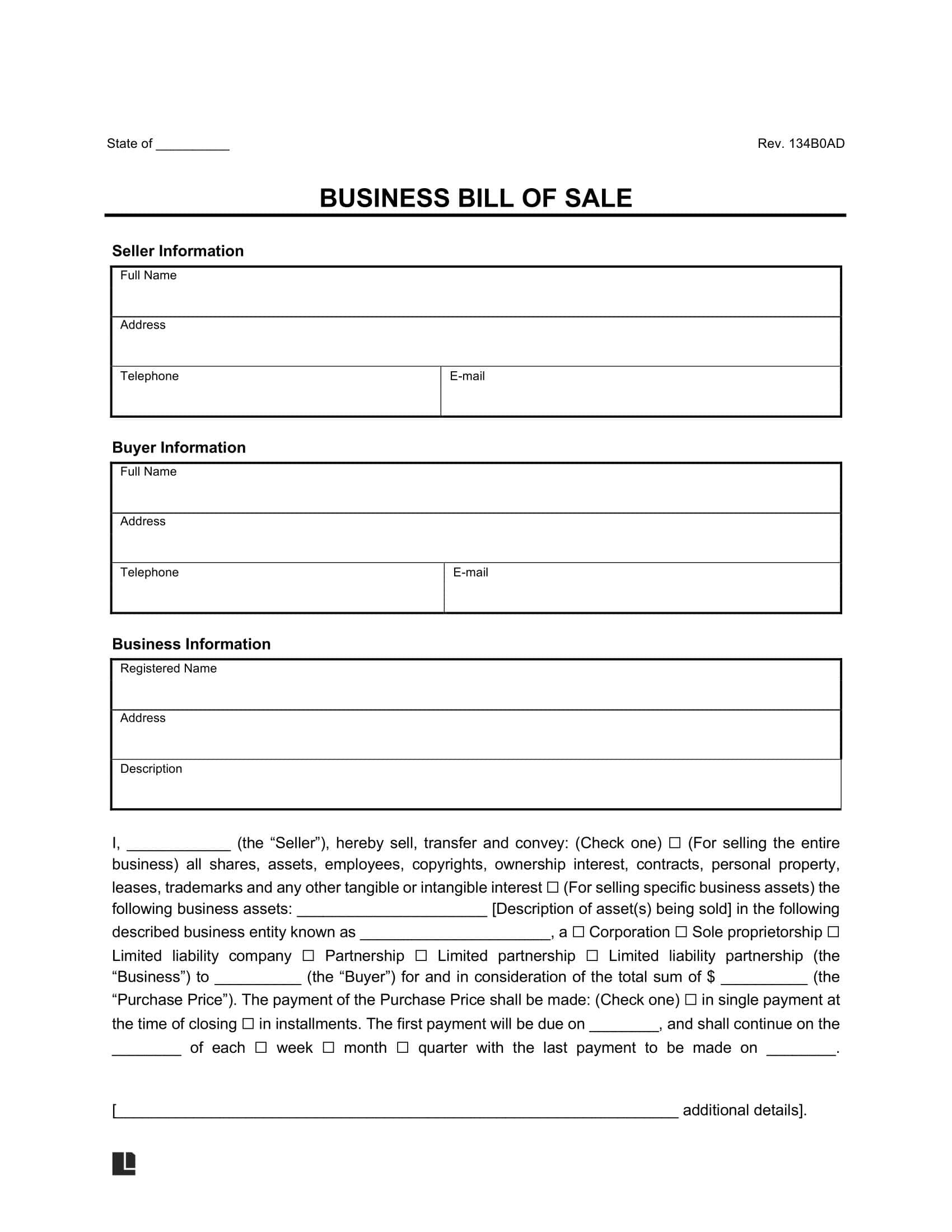

Image Source: eforms.com

Consider using a template to create your Business Entity Bill of Sale Form, as this can help ensure that all necessary details are included and that the document is legally sound.

3. Hire a Lawyer

If you are unsure about how to create a Business Entity Bill of Sale Form, consider hiring a lawyer to help you draft the document and ensure that all legal requirements are met.

4. Include All Necessary Details

Image Source: cocosign.com

Make sure to include all necessary details in your Business Entity Bill of Sale Form, such as the names of the buyer and seller, the purchase price, payment method, and any conditions of the sale.

5. Review and Sign the Form

Once the Business Entity Bill of Sale Form is complete, review it carefully to ensure that all details are accurate and complete. Both the buyer and seller should then sign the form to make it legally binding.

6. Keep a Copy

Image Source: freeforms.com

After the Business Entity Bill of Sale Form is signed, make sure to keep a copy for your records. This document may be necessary for legal or tax purposes in the future.

7. File the Form

Depending on your jurisdiction, you may need to file the Business Entity Bill of Sale Form with the appropriate government agency. Make sure to follow all necessary procedures to ensure that the sale is legally recognized.

8. Seek Legal Advice

Image Source: legaltemplates.net

If you have any questions or concerns about creating a Business Entity Bill of Sale Form, consider seeking legal advice to ensure that your document is legally sound and meets all requirements.

Tips for Successful Business Entity Bill of Sale Form

When creating a Business Entity Bill of Sale Form, keep the following tips in mind to ensure a successful transaction:

Image Source: esign.com

Be Detailed: Include all relevant details about the business being sold to avoid any misunderstandings.

Use a Template: Consider using a template to ensure that all necessary information is included in the form.

Seek Legal Advice: If you are unsure about any aspect of the sale, consult with a lawyer to ensure that your document is legally sound.

Keep Records: Make sure to keep a copy of the Business Entity Bill of Sale Form for your records, as it may be needed for legal or tax purposes in the future.

File Correctly: Depending on your jurisdiction, you may need to file the form with the appropriate government agency. Make sure to follow all necessary procedures to ensure the sale is legally recognized.

Review Carefully: Before signing the form, review it carefully to ensure that all details are accurate and complete.