Budgeting as a couple can be a challenging task, but it is essential for financial stability and harmony in a relationship. Creating a couple budget template can help you and your partner track expenses, set financial goals, and work together towards a common financial future. In this article, we will discuss the purpose of a couple budget template, why it is important, how to create one, and tips for successful budgeting as a couple.

What is a Couple Budget Template?

A couple budget template is a tool that helps you and your partner manage your finances effectively. It typically includes categories for different types of expenses, such as housing, utilities, groceries, entertainment, savings, and debt payments. By tracking your income and expenses in a couple budget template, you can identify areas where you may be overspending and make adjustments to better align your spending with your financial goals.

The Purpose of a Couple Budget Template

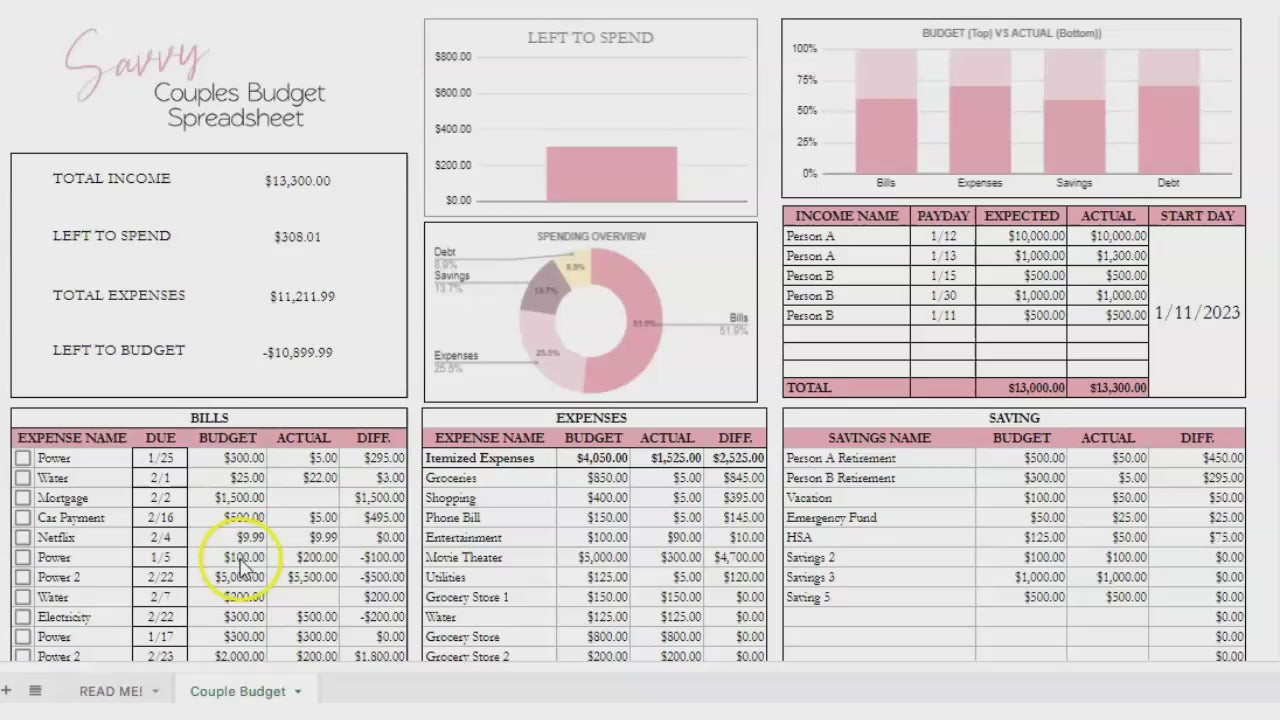

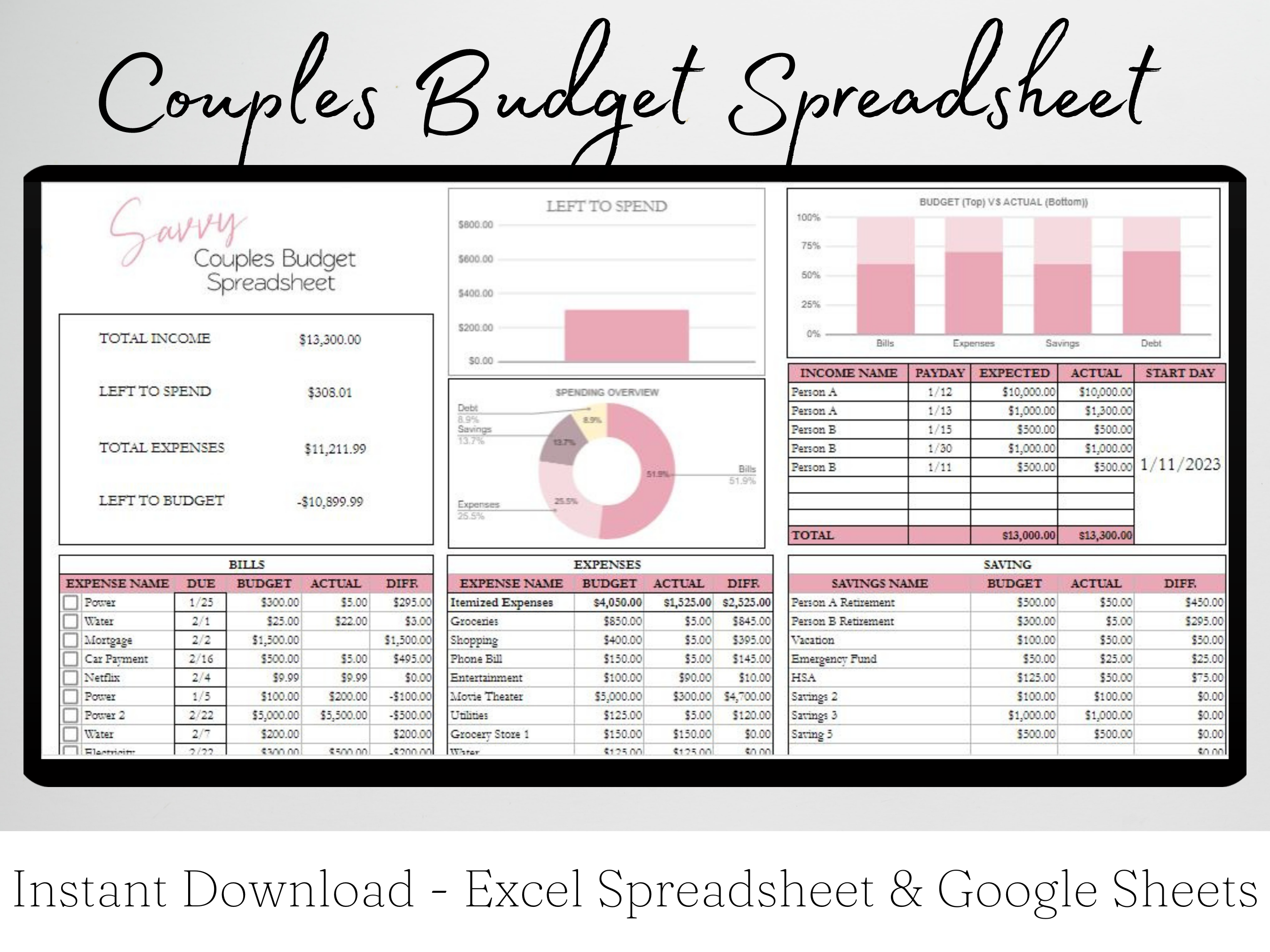

Image Source: savvyandthriving.com

The purpose of a couple budget template is to help you and your partner communicate about money, set financial goals, and work together to achieve them. By creating a budget template, you can see where your money is going each month, identify areas where you can cut back on expenses, and save more money for the future. A couple budget template can also help you plan for major expenses, such as buying a house, starting a family, or saving for retirement.

Why Create a Couple Budget Template?

Creating a couple budget template is important for several reasons. First, it allows you and your partner to have a clear picture of your financial situation and make informed decisions about your money. Second, a couple budget template can help you avoid financial stress and arguments by setting clear guidelines for spending and saving. Finally, a couple budget template can help you achieve your financial goals, whether that is saving for a vacation, paying off debt, or building an emergency fund.

How to Create a Couple Budget Template

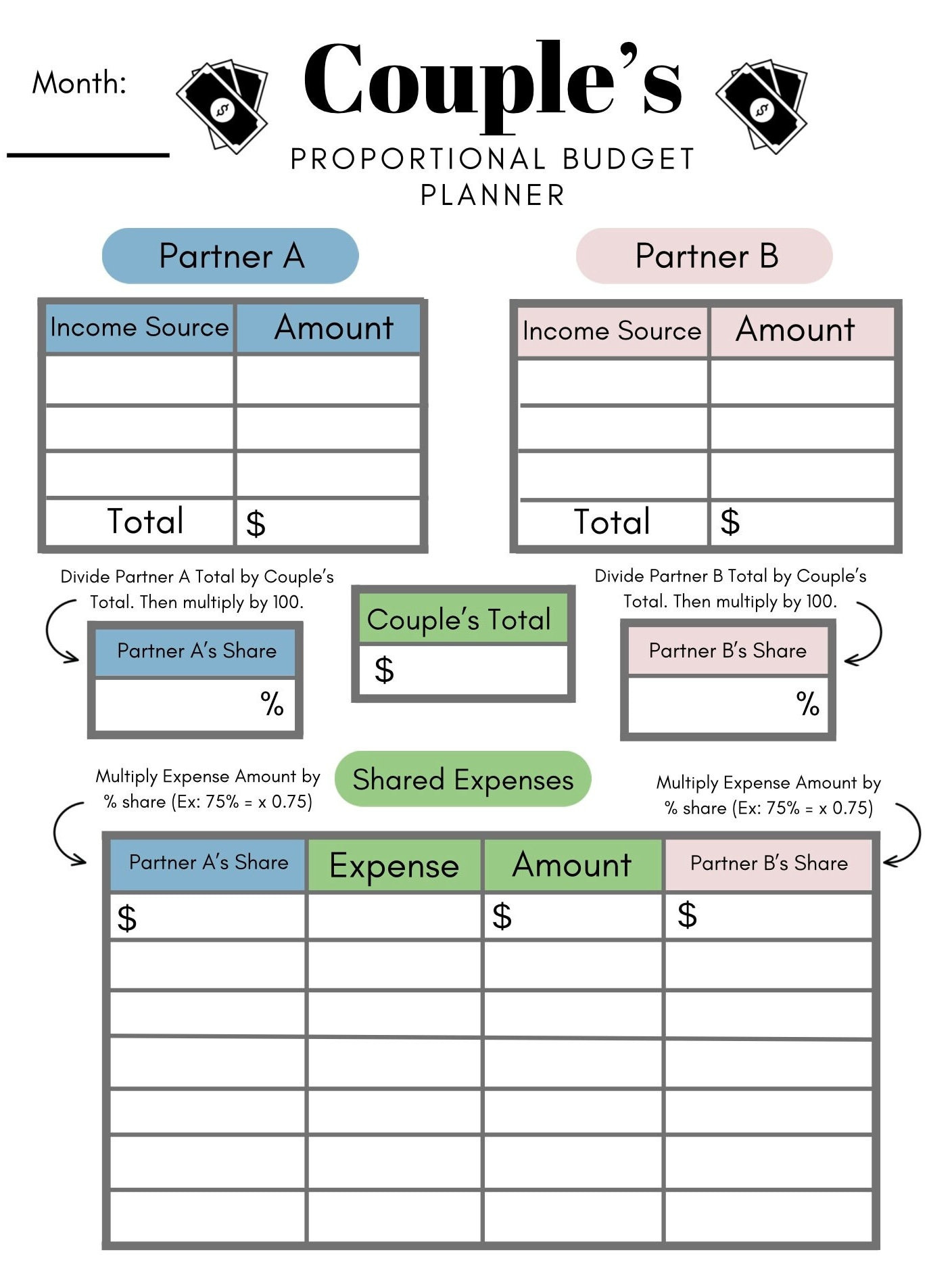

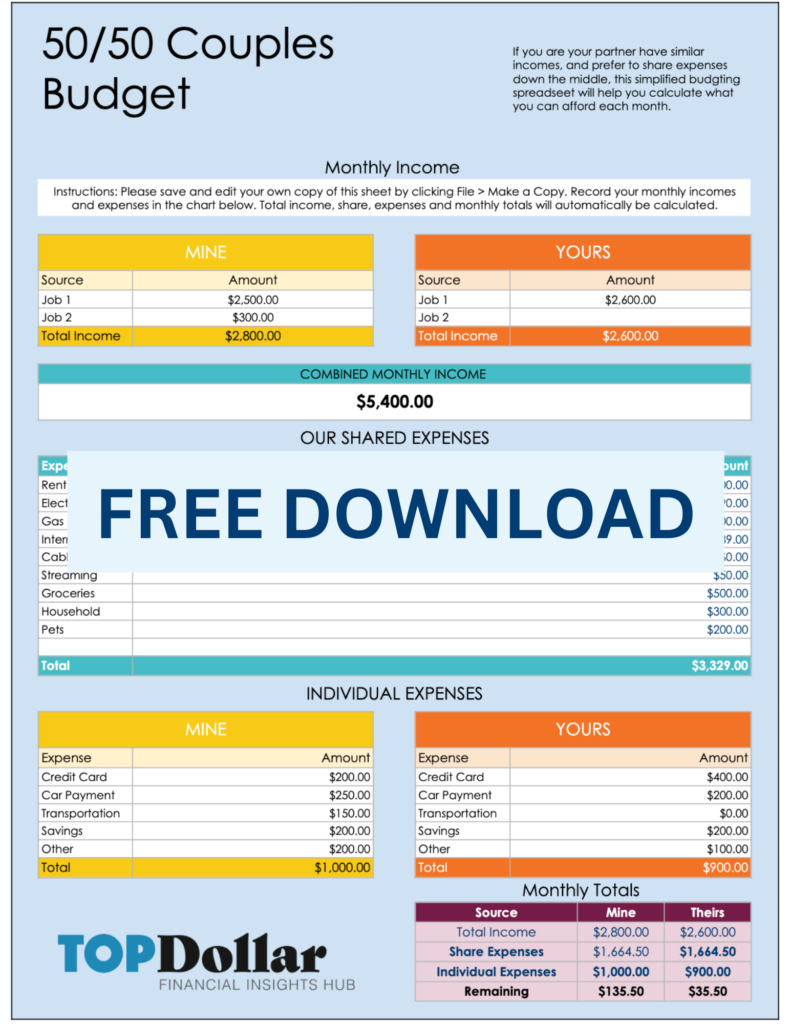

Image Source: etsystatic.com

Creating a couple budget template is a straightforward process that involves the following steps:

1. Determine your income: Calculate your total monthly income, including salaries, bonuses, and any other sources of income.

2. List your expenses: Make a list of all your monthly expenses, such as rent/mortgage, utilities, groceries, transportation, entertainment, savings, and debt payments.

3. Set financial goals: Discuss with your partner what your financial goals are, whether it’s saving for a down payment on a house, paying off student loans, or building an emergency fund.

4. Allocate funds: Allocate a portion of your income to each expense category, making sure to account for both fixed and variable expenses.

5. Track your spending: Keep track of your expenses throughout the month and compare them to your budgeted amounts.

6. Review and adjust: At the end of the month, review your budget, see where you overspent or underspent, and make adjustments for the following month.

Tips for Successful Budgeting as a Couple

Successfully managing finances as a couple requires communication, compromise, and commitment. Here are some tips for successful budgeting as a couple:

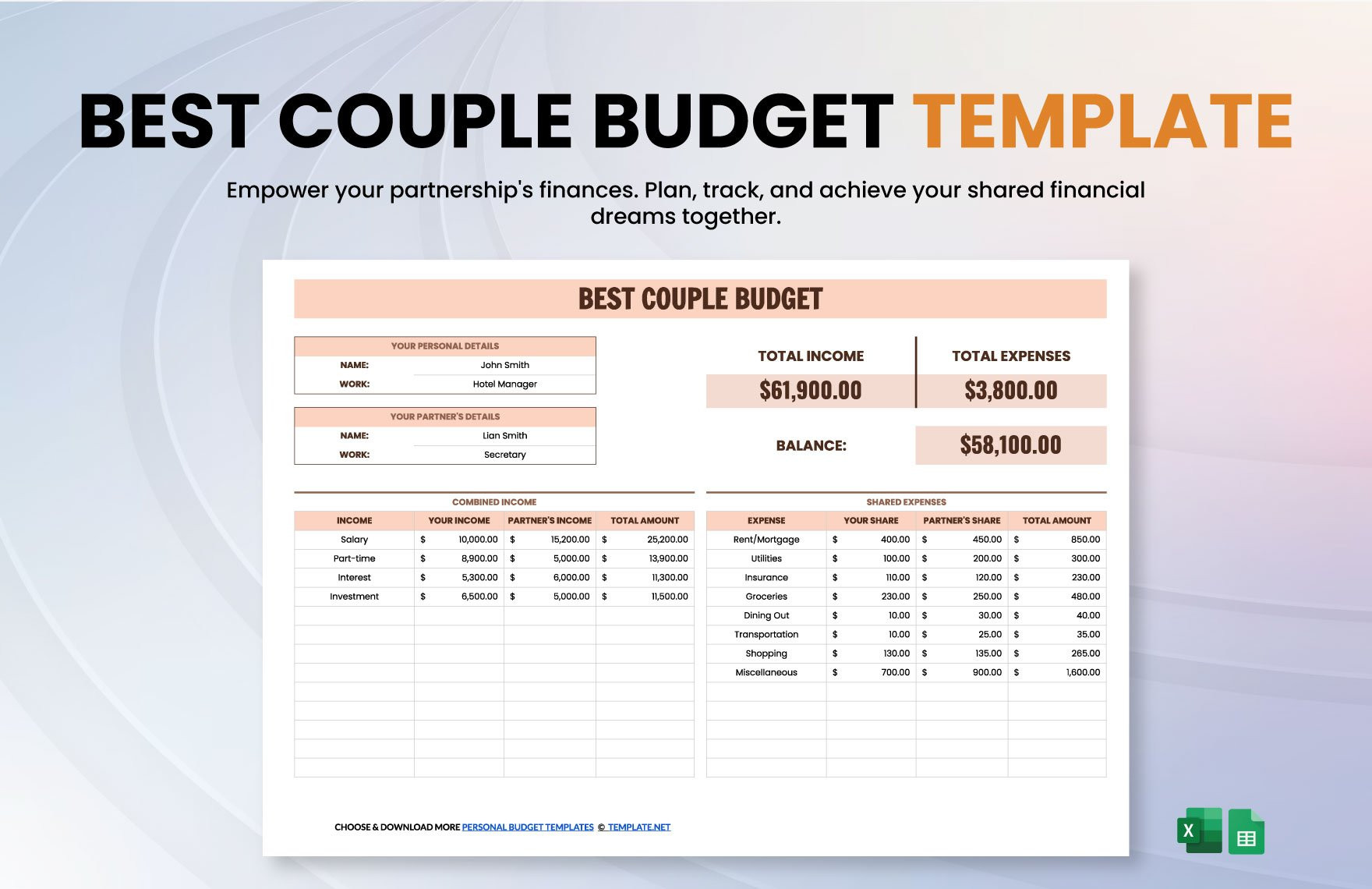

Image Source: template.net

Regularly communicate: Schedule monthly budget meetings to discuss your financial goals, review your budget, and make any necessary adjustments.

Be transparent: Be honest with your partner about your financial habits, debts, and goals to ensure that you are on the same page.

Set realistic goals: Set achievable financial goals that align with your values and priorities as a couple.

Celebrate milestones: Celebrate when you reach a financial milestone, whether it’s paying off a debt or reaching a savings goal.

Seek help if needed: If you are struggling to create or stick to a budget, consider seeking help from a financial advisor or counselor.

Be flexible: Be willing to adjust your budget as needed and make compromises to accommodate unexpected expenses or changes in your financial situation.

In conclusion, creating a couple budget template is a valuable tool for managing your finances as a couple. By working together to set financial goals, track expenses, and make informed decisions about your money, you can build a strong financial foundation for your future together. Remember to communicate openly with your partner, be transparent about your financial situation, and celebrate your achievements along the way. With dedication and commitment, you can achieve financial stability and harmony in your relationship.

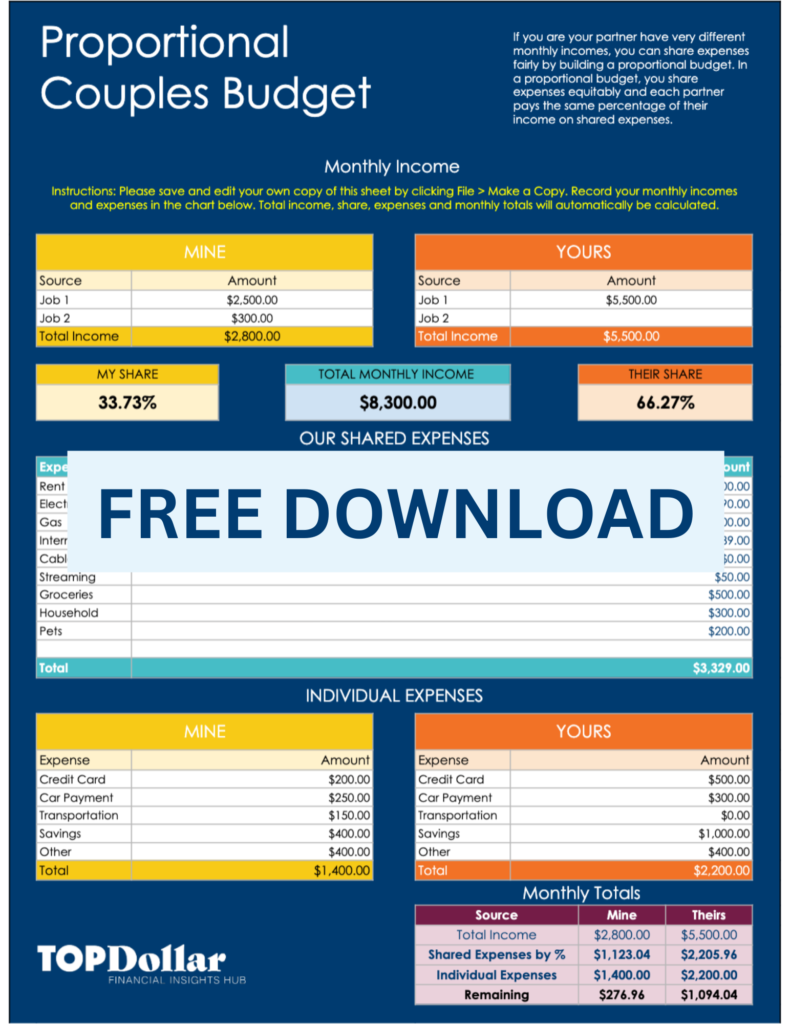

Image Source: accrediteddebtrelief.com

Image Source: savvyandthriving.com

Image Source: accrediteddebtrelief.com