Managing a family budget can be a challenging task, especially with the various expenses that come with raising a family. Whether you are a single parent, a couple, or a large family, having a budget template in place can help you keep track of your income and expenses, and ensure that you are living within your means. A family budget template is a tool that can help you plan and manage your finances effectively, allowing you to save for the future and achieve your financial goals.

What is a Family Budget Template?

A family budget template is a document that helps you track your income, expenses, savings, and investments. It typically includes categories for different types of expenses such as housing, transportation, food, entertainment, and savings. By using a budget template, you can easily see where your money is going each month and make informed decisions about your spending habits.

The Purpose of a Family Budget Template

Image Source: etsystatic.com

The main purpose of a family budget template is to help you manage your finances more effectively. By tracking your income and expenses, you can identify areas where you may be overspending and make adjustments to your budget accordingly. A budget template can also help you save for important financial goals such as buying a home, saving for your children’s education, or planning for retirement.

Why Use a Family Budget Template?

There are several benefits to using a family budget template. Firstly, it can help you avoid financial stress by ensuring that you are living within your means and not overspending. It can also help you save money by identifying areas where you can cut back on expenses. Additionally, a budget template can help you achieve your financial goals by allowing you to track your progress and make adjustments as needed.

How to Create a Family Budget Template

Image Source: jotfor.ms

Creating a family budget template is relatively simple. Start by listing all sources of income for your family, including salaries, bonuses, and any other income. Next, list all of your expenses, including fixed expenses such as rent/mortgage payments, utilities, and insurance, as well as variable expenses such as groceries, dining out, and entertainment. Finally, subtract your expenses from your income to determine your monthly savings or shortfall.

1. List Your Income

To create a family budget template, start by listing all sources of income for your family. This can include salaries, bonuses, rental income, and any other sources of income that you may have.

2. Identify Your Expenses

Image Source: smartsheet.com

Next, identify all of your expenses, both fixed and variable. Fixed expenses are those that remain the same each month, such as rent/mortgage payments, utilities, and insurance. Variable expenses are those that can fluctuate, such as groceries, dining out, and entertainment.

3. Create Categories

Organize your expenses into categories such as housing, transportation, food, entertainment, savings, and debt repayment. This will help you track your spending and identify areas where you may be overspending.

4. Set Financial Goals

Image Source: canva.com

Set short-term and long-term financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. Having clear goals can help you stay motivated and focused on your budget.

5. Track Your Spending

Regularly track your spending against your budget to ensure that you are staying on track. This can help you identify any areas where you may be overspending and make adjustments as needed.

6. Review and Adjust

Image Source: generalblue.com

Review your budget regularly and make adjustments as needed. Life circumstances can change, so it’s important to be flexible and make changes to your budget as necessary.

7. Communicate with Your Family

It’s important to communicate with your family members about the budget and get their input on financial decisions. This can help ensure that everyone is on the same page and working towards common financial goals.

8. Seek Professional Help if Needed

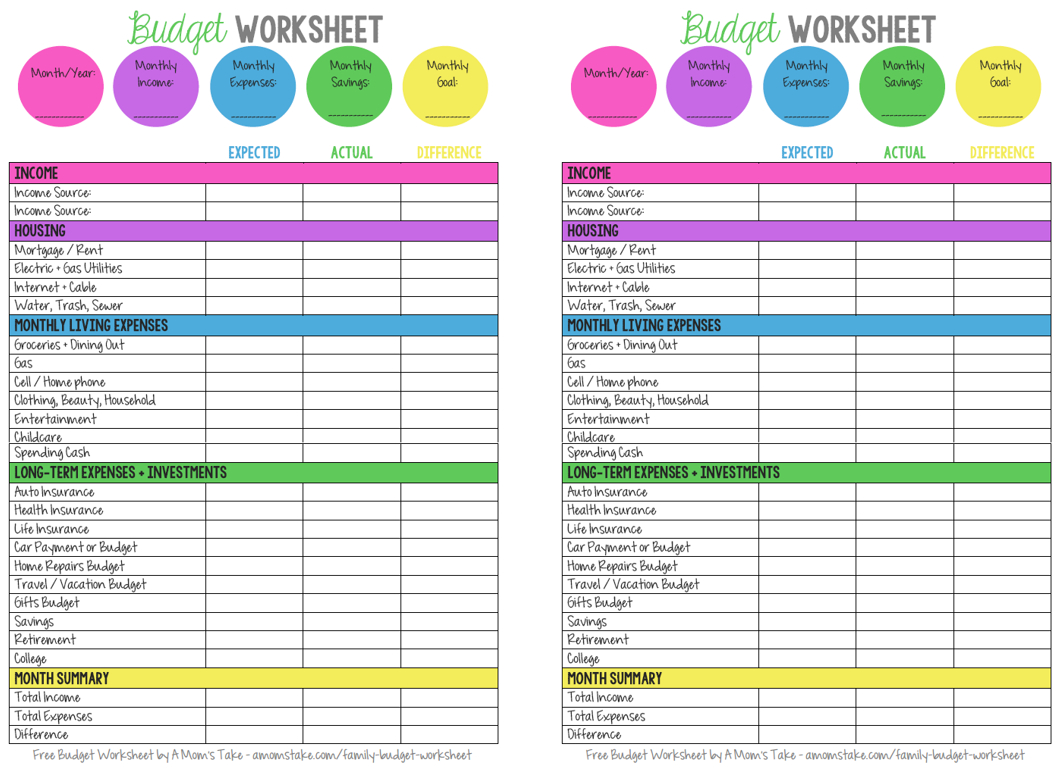

Image Source: amomstake.com

If you are struggling to create or stick to a budget, don’t hesitate to seek help from a financial advisor or counselor. They can provide guidance and support to help you achieve your financial goals.

Tips for Successful Family Budgeting

Track Your Expenses: Keep track of all your expenses, no matter how small, to get a clear picture of your spending habits.

Automate Savings: Set up automatic transfers to your savings account to ensure that you are consistently saving money each month.

Use Cash Envelopes: Consider using the cash envelope system to allocate specific amounts of cash for different spending categories.

Plan for Irregular Expenses: Budget for irregular expenses such as car repairs or medical bills to avoid financial surprises.

Review Your Budget Regularly: Take the time to review your budget on a monthly basis and make adjustments as needed.

Celebrate Your Wins: Celebrate your financial milestones, whether it’s paying off debt or reaching a savings goal, to stay motivated on your financial journey.

Image Source: i0.wp.com

In conclusion, creating and sticking to a family budget template can help you achieve your financial goals, reduce financial stress, and improve your overall financial well-being. By tracking your income and expenses, setting financial goals, and making adjustments as needed, you can take control of your finances and work towards a secure financial future for your family.

Image Source: wondermomwannabe.com

Image Source: generalblue.com

Image Source: amomstake.com