Creating a budget is an essential part of managing your finances, and having a good budget template can make the process much easier. Whether you are new to budgeting or looking to revamp your current budgeting system, a well-designed template can help you stay organized and on track with your financial goals. In this article, we will explore the importance of using a good budget template, as well as provide tips on how to create and utilize one effectively.

What is a Budget Template?

A budget template is a pre-designed spreadsheet or document that helps individuals or businesses track their income, expenses, and savings over a specific period of time. It typically includes categories for different types of expenses, such as housing, transportation, groceries, entertainment, and more. A budget template can also include sections for setting financial goals, tracking debt repayment, and monitoring progress towards achieving those goals.

The Purpose of Using a Budget Template

Image Source: thegoodocs.com

The main purpose of using a budget template is to gain a clear understanding of your financial situation and make informed decisions about your money. By categorizing your income and expenses, you can see where your money is going each month and identify areas where you can cut back or reallocate funds. A budget template also allows you to set realistic financial goals, track your progress, and make adjustments as needed to stay on track.

Why You Should Use a Budget Template

Using a budget template can provide numerous benefits, such as:

1. Increased awareness of your spending habits

2. Improved financial decision-making

3. Better control over your finances

4. Ability to save for short-term and long-term goals

5. Reduced financial stress

6. Enhanced financial security

7. Improved communication with your partner or family members about money

8. Greater accountability for your financial choices

How to Create and Use a Budget Template

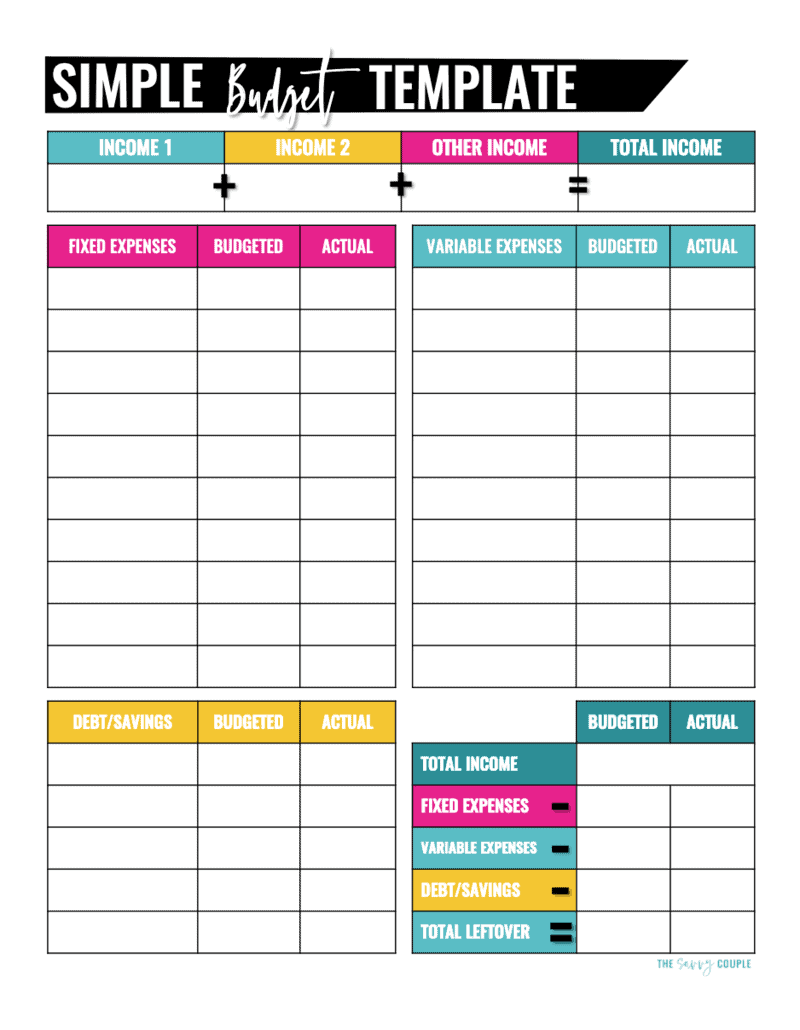

Image Source: pinimg.com

Creating a budget template is a relatively simple process that can be customized to fit your specific financial goals and needs. Here are some steps to help you create and use a budget template effectively:

1. Start by listing all sources of income, including wages, bonuses, rental income, etc.

2. Next, list all of your expenses, including fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

3. Categorize your expenses into groups, such as housing, transportation, food, and entertainment.

4. Set realistic financial goals for saving, debt repayment, and other financial priorities.

5. Track your spending each month and compare it to your budgeted amounts.

6. Make adjustments to your budget as needed to stay on track with your financial goals.

7. Review your budget regularly to ensure you are making progress towards your financial goals.

8. Use budgeting tools or apps to automate tracking and categorizing expenses for easier budget management.

Tips for Successful Budgeting

Set realistic goals: Make sure your budget reflects your financial priorities and is achievable within your current income.

Track your spending: Keep a close eye on your expenses to identify areas where you can cut back and save money.

Communicate with family members: If you share finances with a partner or family members, make sure everyone is on the same page about financial goals and spending habits.

Stay flexible: Life changes and unexpected expenses can occur, so be prepared to adjust your budget as needed.

Reward yourself: Celebrate small victories along the way to stay motivated and engaged with your budgeting process.

Seek help if needed: If you are struggling with budgeting or managing your finances, consider seeking help from a financial advisor or counselor.

Image Source: i0.wp.com

In Conclusion

A good budget template is a valuable tool for managing your finances effectively and achieving your financial goals. By using a budget template, you can gain a clearer understanding of your financial situation, make informed decisions about your money, and work towards a more secure financial future. Take the time to create a budget template that works for you, and remember to review and adjust it regularly to stay on track with your financial goals.

Image Source: scene7.com

Image Source: smartsheet.com

Image Source: clockify.me

Image Source: freebiefindingmom.com

Image Source: worldofprintables.com

Image Source: canva.com

Image Source: thesavvymama.com