Homeowners Association Budget Template: A Comprehensive Guide

Managing the finances of a homeowners association (HOA) can be a challenging task, especially when it comes to creating a budget that meets the needs of the community. A well-designed budget template is essential for ensuring that the HOA can effectively plan for expenses, allocate resources, and maintain the overall financial health of the association. In this article, we will explore the importance of a homeowners association budget template, the purpose it serves, why it is necessary, how to create one, and provide some tips for successful budgeting.

What is a Homeowners Association Budget Template?

Image Source: hehoa.com

A homeowners association budget template is a tool that helps HOA board members and property managers plan for and track the financial activities of the association. It is a detailed document that outlines the projected expenses and income for a specific period, typically one fiscal year. The budget template serves as a roadmap for financial decision-making, ensuring that the association’s funds are allocated appropriately and in accordance with the community’s needs.

The Purpose of a Homeowners Association Budget Template

The primary purpose of a homeowners association budget template is to provide a clear and organized framework for managing the association’s finances. By creating a budget template, the HOA board can:

Image Source: pinimg.com

– Plan for future expenses and anticipate revenue streams

– Allocate resources effectively to meet the needs of the community

– Monitor financial performance and make adjustments as needed

– Ensure transparency and accountability in financial decision-making

– Communicate financial goals and priorities to homeowners

Why Do Homeowners Associations Need a Budget Template?

Having a budget template is crucial for homeowners associations for several reasons. Without a well-defined budget, the association may struggle to:

Image Source: communityfinancials.com

– Plan for unexpected expenses or emergency repairs

– Maintain common areas and amenities

– Collect assessments and fees in a timely manner

– Meet legal and financial obligations

– Build reserves for future projects or repairs

How to Create a Homeowners Association Budget Template

Creating a homeowners association budget template involves several key steps. Here is a guide to help you get started:

Image Source: pinimg.com

1. Review Financial Statements: Begin by reviewing the association’s financial statements from the previous year to understand revenue sources, expenses, and any existing budget constraints.

2. Identify Income Sources: Determine all sources of income, including monthly assessments, special assessments, interest income, and any other revenue streams.

Image Source: communityfinancials.com

3. Estimate Expenses: List all anticipated expenses for the upcoming year, including utilities, maintenance, insurance, landscaping, repairs, administrative costs, and any planned capital improvements.

4. Allocate Funds: Distribute funds to different categories based on priority and necessity, such as operating expenses, reserve funds, and contingency funds.

Image Source: communityfinancials.com

5. Monitor and Adjust: Regularly monitor the association’s financial performance against the budget and make adjustments as needed to ensure that expenses align with revenue.

Tips for Successful Homeowners Association Budgeting

Creating and maintaining a homeowners association budget template requires careful planning and attention to detail. Here are some tips to help you successfully manage your HOA finances:

Image Source: pinimg.com

Involve Stakeholders: Engage homeowners in the budgeting process to gain their input and support.

Seek Professional Guidance: Consider working with a financial advisor or accountant to ensure accuracy and compliance with financial regulations.

Plan for Contingencies: Set aside funds for unexpected expenses or emergencies to avoid budget shortfalls.

Communicate Effectively: Keep homeowners informed about the budgeting process, financial goals, and any changes to assessments or fees.

Review Regularly: Conduct regular budget reviews to track performance, identify trends, and make necessary adjustments to the budget template.

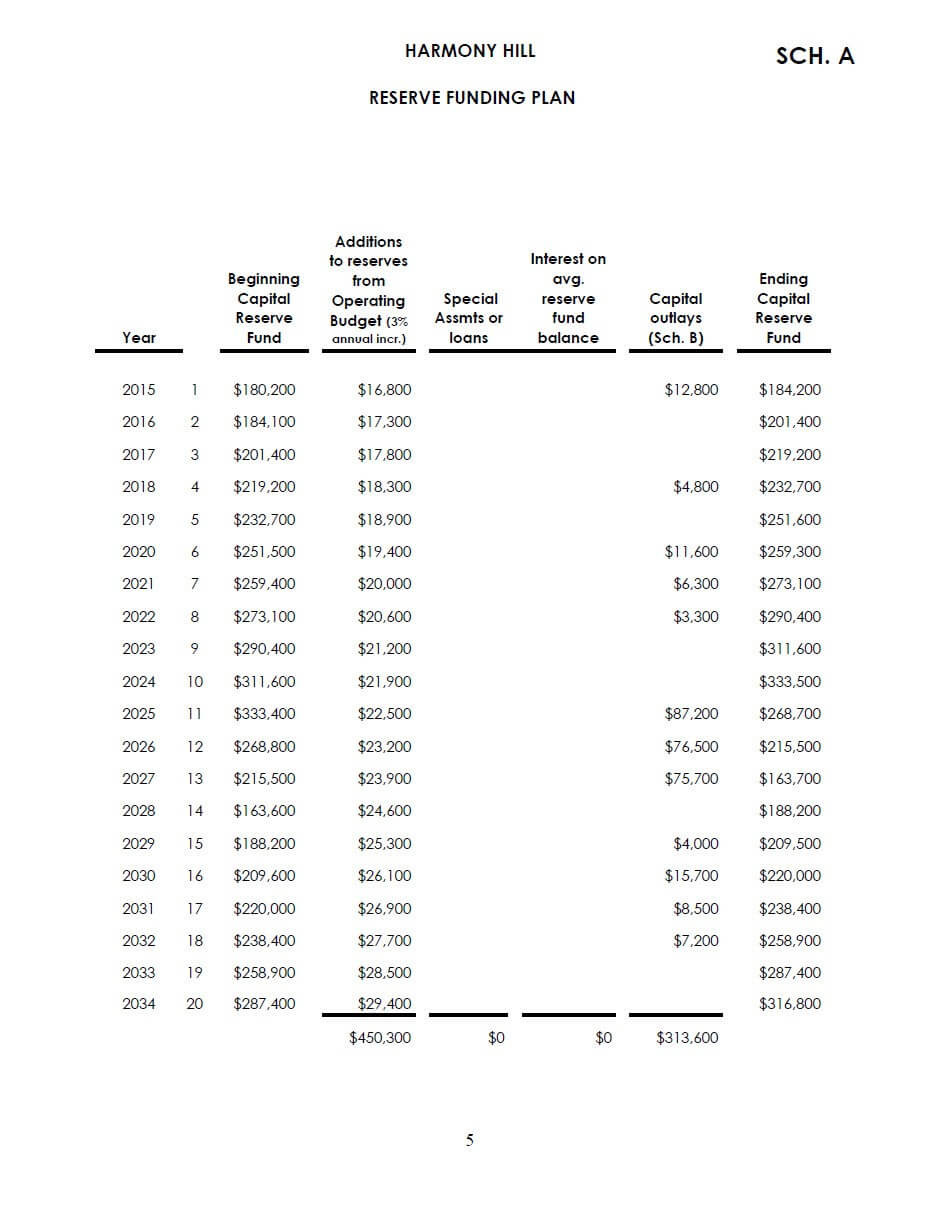

Build Reserves: Establish and maintain reserve funds to cover major repairs or capital projects without relying on special assessments.

In conclusion, a homeowners association budget template is a critical tool for managing the financial affairs of the association and ensuring the long-term sustainability of the community. By following the steps outlined in this guide and implementing the tips provided, HOA board members and property managers can create a comprehensive budget template that meets the needs of the community and promotes financial stability.

Image Source: wordpress.com