As a business owner, keeping track of your expenses and revenue is crucial for the success and growth of your business. One tool that can greatly assist you in this process is an itemized receipt.

In this article, we will explore what an itemized receipt is, why it is important for business owners, and how to effectively utilize it to streamline your financial management.

What is an Itemized Receipt?

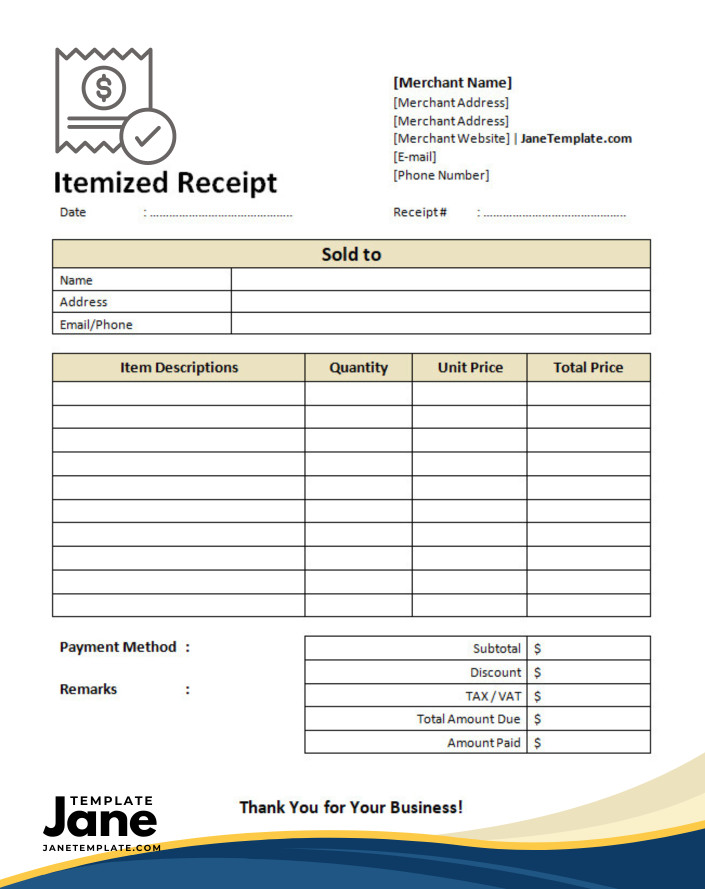

An itemized receipt is a detailed document that provides a breakdown of the products or services purchased by a customer. It includes information such as the name of the business, date and time of purchase, description of each item or service, quantity, unit price, and the total amount paid. It allows both the business owner and the customer to have a clear record of the transaction.

These receipts offer several benefits for business owners:

- Proof of Purchase: A receipt serves as proof that a transaction has taken place. It can be used to resolve any disputes or discrepancies that may arise with customers.

- Tax Deductions: With a receipt, you can accurately track your business expenses and claim deductions during tax season. This can help reduce your taxable income and potentially save you money.

- Inventory Management: By recording the details of each item sold, a receipt can help you keep track of your inventory. This information can be valuable for restocking purposes and identifying the popularity of certain products or services.

- Customer Satisfaction: Providing a receipt to your customers shows transparency and professionalism. It gives them confidence in their purchase and can help build trust and loyalty.

How to Create an Itemized Receipt

Creating a receipt is relatively straightforward. Here are the basic steps:

- Include Business Information: Start by adding your business name, address, phone number, and email at the top of the receipt. This helps identify your business and provides contact information if needed.

- Date and Time: Clearly state the date and time of the transaction. This helps with record-keeping and allows for easier tracking of sales.

- Item Description and Quantity: List each item or service purchased along with a brief description and the quantity. Be specific and provide any relevant details that will help both you and the customer identify the product or service.

- Unit Price and Total: Include the price per unit for each item and calculate the total amount for each line item. Ensure that the calculations are accurate and easy to understand.

- Tax and Discounts: If applicable, clearly indicate any taxes or discounts applied to the transaction. This ensures transparency and avoids any confusion.

- Payment Details: Specify the payment method used by the customer, such as cash, credit card, or online payment. Include the total amount paid and any change given (if applicable).

- Additional Notes: Leave space for any additional notes or comments that may be relevant to the transaction.

- Contact Information: Provide your contact information again at the bottom of the receipt in case the customer needs to reach out to you for any reason.

The Benefits of Utilizing Receipts

By implementing the use of receipts in your business, you can experience numerous advantages:

- Accurate Financial Records: Receipts provide a clear and detailed overview of your sales and expenses. This allows for accurate bookkeeping and financial analysis.

- Easier Auditing: Having organized receipts makes the auditing process much smoother. You can easily locate and provide evidence for each transaction.

- Better Decision-Making: With access to detailed transaction data, you can make more informed decisions about your business. Analyzing sales patterns and customer preferences can help you optimize your product offerings and marketing strategies.

- Satisfied Customers: Providing itemized receipts to your customers demonstrates professionalism and a commitment to transparency. This can enhance their overall experience and encourage repeat business.

- Legal Compliance: In many jurisdictions, businesses are required by law to provide itemized receipts to customers. By adhering to these regulations, you avoid potential legal issues and protect your business reputation.

Bottom Line

As a business owner, it is essential to understand the importance of itemized receipts. They serve as proof of purchase, aid in tax deductions, help with inventory management, and enhance customer satisfaction. By creating and utilizing itemized receipts effectively, you can improve your financial management practices, make informed business decisions, and ensure legal compliance. Invest time in implementing proper receipt procedures to reap the benefits in the long run.

Simplify your record-keeping with our Itemized Receipt Template in Word, available for immediate download. This template offers a customizable format for creating detailed receipts, including itemized lists of purchased items, quantities, prices, and totals. Whether for business or personal use, this template ensures accurate documentation of transactions.

Download now for a convenient and professional solution to generate itemized receipts effortlessly.

Itemized Receipt Template Word – Download