Money receipts are an essential part of financial transactions, serving as a proof of payment or purchase. Whether you are running a business, freelancing, or simply keeping track of personal expenses, having a record of money received is crucial for maintaining financial transparency and organization. In this article, we will delve into the intricacies of money receipts, exploring their purpose, importance, and how to effectively create and manage them.

What is a Money Receipt?

A money receipt, also known as a payment receipt or cash receipt, is a document issued by a seller or service provider to a buyer or client to acknowledge the payment of goods or services. It typically includes details such as the amount paid, date of payment, description of the items purchased or services rendered, and the names of the parties involved in the transaction. Money receipts can be issued in various forms, including paper receipts, electronic receipts, or digital receipts.

The Purpose of Money Receipts

Image Source: behance.net

The primary purpose of a money receipt is to provide evidence of a financial transaction and serve as a record of payment. Money receipts play a crucial role in accounting and bookkeeping, helping businesses and individuals track their income, expenses, and financial activities. Additionally, money receipts can be used for tax purposes, as they provide documentation of deductible expenses and revenue earned. By maintaining organized and accurate money receipts, individuals and businesses can ensure financial transparency, compliance with regulations, and effective financial management.

Why are Money Receipts Important?

Money receipts are important for several reasons:

– Legal Protection: Money receipts serve as legal evidence of a financial transaction, protecting both the buyer and seller in case of disputes or discrepancies.

– Accounting and Bookkeeping: Money receipts are essential for tracking income, expenses, and financial transactions, which is crucial for budgeting, financial planning, and decision-making.

– Tax Compliance: Money receipts provide documentation of deductible expenses and income, helping individuals and businesses comply with tax regulations and maximize tax deductions.

– Customer Satisfaction: Providing customers with a clear and detailed money receipt enhances transparency, professionalism, and trust in the business-client relationship.

How to Create a Money Receipt

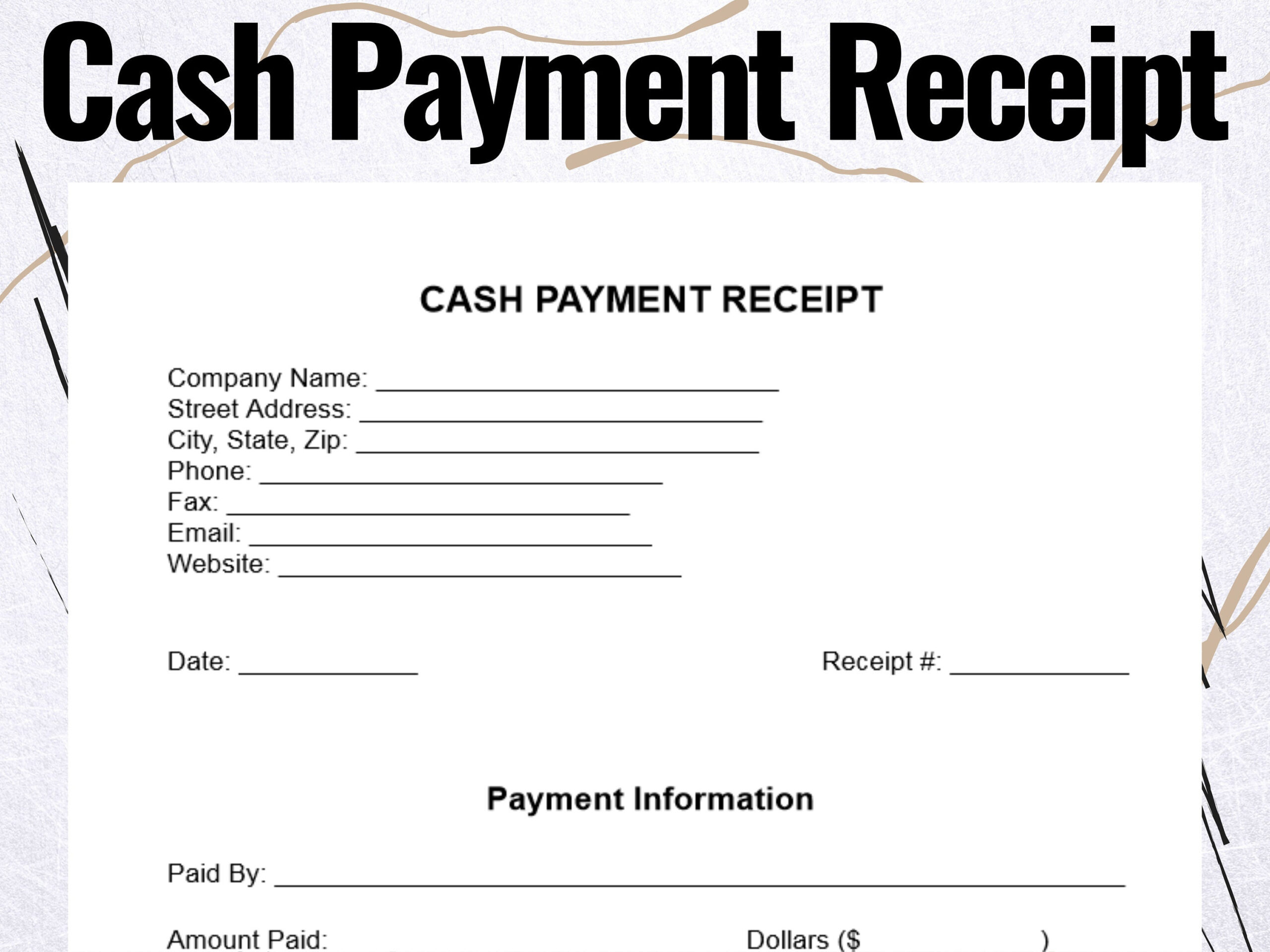

Image Source: etsystatic.com

Creating a money receipt is a simple process that involves including essential information about the transaction. Here are some steps to follow when creating a money receipt:

1. Include the date of the transaction and the receipt number for reference.

2. Clearly state the amount paid and the currency used in the transaction.

3. Provide a description of the items purchased or services rendered.

4. Include the names and contact information of the buyer and seller.

5. Add any additional terms or conditions related to the transaction.

6. Sign and stamp the receipt for authenticity.

7. Provide a copy of the receipt to the buyer and keep a duplicate for your records.

Tips for Successful Money Receipt Management

Managing money receipts effectively is essential for maintaining financial organization and compliance. Here are some tips for successful money receipt management:

Image Source: typecalendar.com

Digitize Your Receipts. Consider using digital receipt management tools or apps to store and organize your money receipts electronically.

Organize by Categories. Categorize your money receipts by type of expense, project, or client to easily track and access relevant information.

Regularly Review and Reconcile. Review your money receipts regularly to ensure accuracy, identify any discrepancies, and reconcile them with your financial records.

Back Up Your Receipts. Make backup copies of your money receipts in case of loss or damage, either digitally or in physical form.

Consult with a Financial Professional. If you are unsure about proper money receipt management or need guidance on tax implications, consider consulting with a financial advisor or accountant.

Stay Organized. Develop a system for organizing and storing your money receipts, whether it’s using folders, binders, or digital filing systems, to easily retrieve information when needed.

In conclusion, money receipts are an essential aspect of financial transactions, providing a record of payments made and received. By understanding the purpose of money receipts, creating them effectively, and implementing proper management practices, individuals and businesses can ensure financial transparency, compliance, and organization in their financial activities. Remember to keep track of your money receipts, stay organized, and consult with financial professionals when needed to maximize the benefits of proper money receipt management.

Image Source: scribdassets.com

Image Source: dribbble.com

Image Source: etsystatic.com

Image Source: ytimg.com

Image Source: ytimg.com

Image Source: vecteezy.com