Are you ready to take control of your finances and start budgeting like a pro? One of the best ways to stay on top of your expenses and savings goals is by using a monthly budget template. This tool can help you track your income, expenses, and savings in a systematic and organized manner. Whether you are new to budgeting or looking for a more efficient way to manage your money, a monthly budget template can be a game-changer for your financial well-being.

What is a Monthly Budget Template?

A monthly budget template is a pre-designed spreadsheet or document that helps individuals or households track their income and expenses on a monthly basis. This template typically includes sections for income sources, fixed expenses, variable expenses, savings goals, and any other financial categories that are relevant to your financial situation. By inputting your financial data into the template, you can easily visualize where your money is going and make informed decisions about your spending habits.

The Purpose of Using a Monthly Budget Template

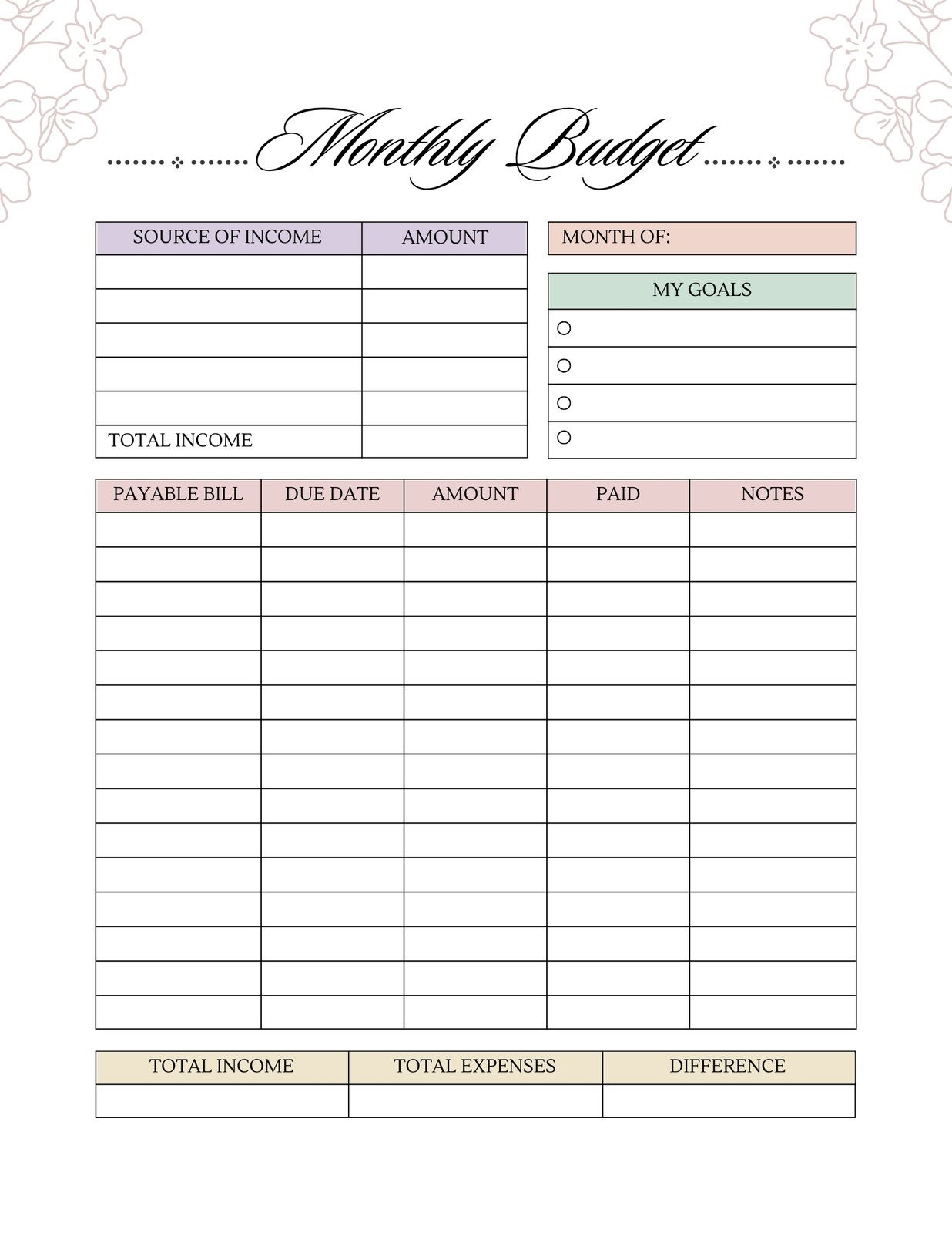

Image Source: abbyorganizes.com

The main purpose of using a monthly budget template is to gain a clear understanding of your financial situation and make informed decisions about your money. By tracking your income and expenses on a monthly basis, you can identify areas where you may be overspending, set realistic savings goals, and ultimately take control of your finances. A monthly budget template can also help you plan for future expenses, such as vacations, home renovations, or major purchases, by allocating funds accordingly.

Why You Should Use a Monthly Budget Template

There are several benefits to using a monthly budget template, regardless of your financial goals. Here are a few reasons why you should consider incorporating a monthly budget template into your financial routine:

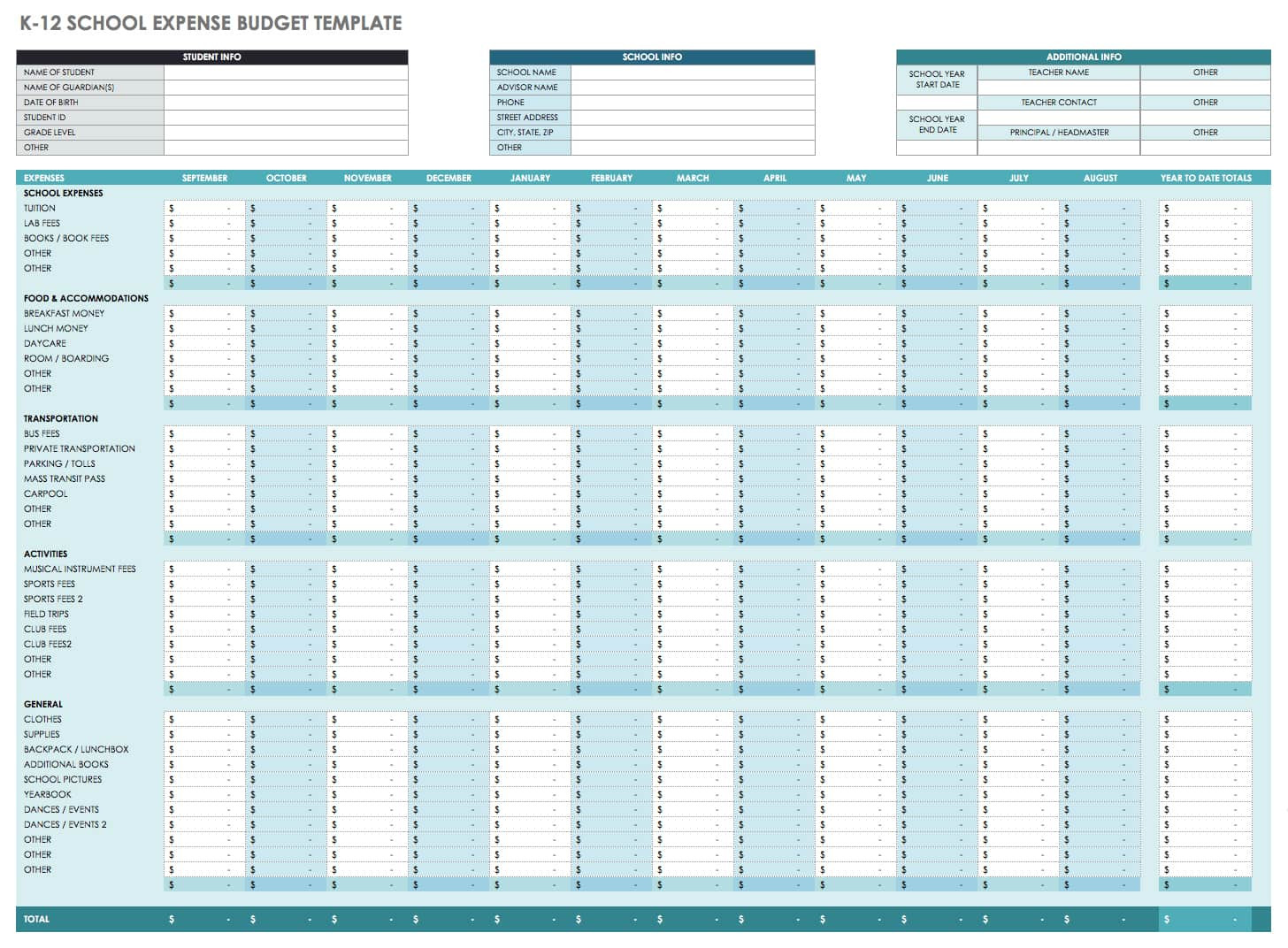

Image Source: smartsheet.com

1. Track Your Expenses: A monthly budget template allows you to track your expenses and identify areas where you may be overspending.

2. Set Realistic Savings Goals: By using a monthly budget template, you can set realistic savings goals and track your progress over time.

3. Plan for Future Expenses: With a monthly budget template, you can allocate funds for future expenses and avoid financial stress when unexpected costs arise.

4. Improve Financial Literacy: Budgeting regularly with a monthly budget template can help improve your financial literacy and make informed decisions about your money.

5. Achieve Financial Freedom: By taking control of your finances with a monthly budget template, you can work towards achieving financial freedom and peace of mind.

How to Use a Monthly Budget Template

Using a monthly budget template is simple and straightforward, even if you have never budgeted before. Here are some steps to help you get started with a monthly budget template:

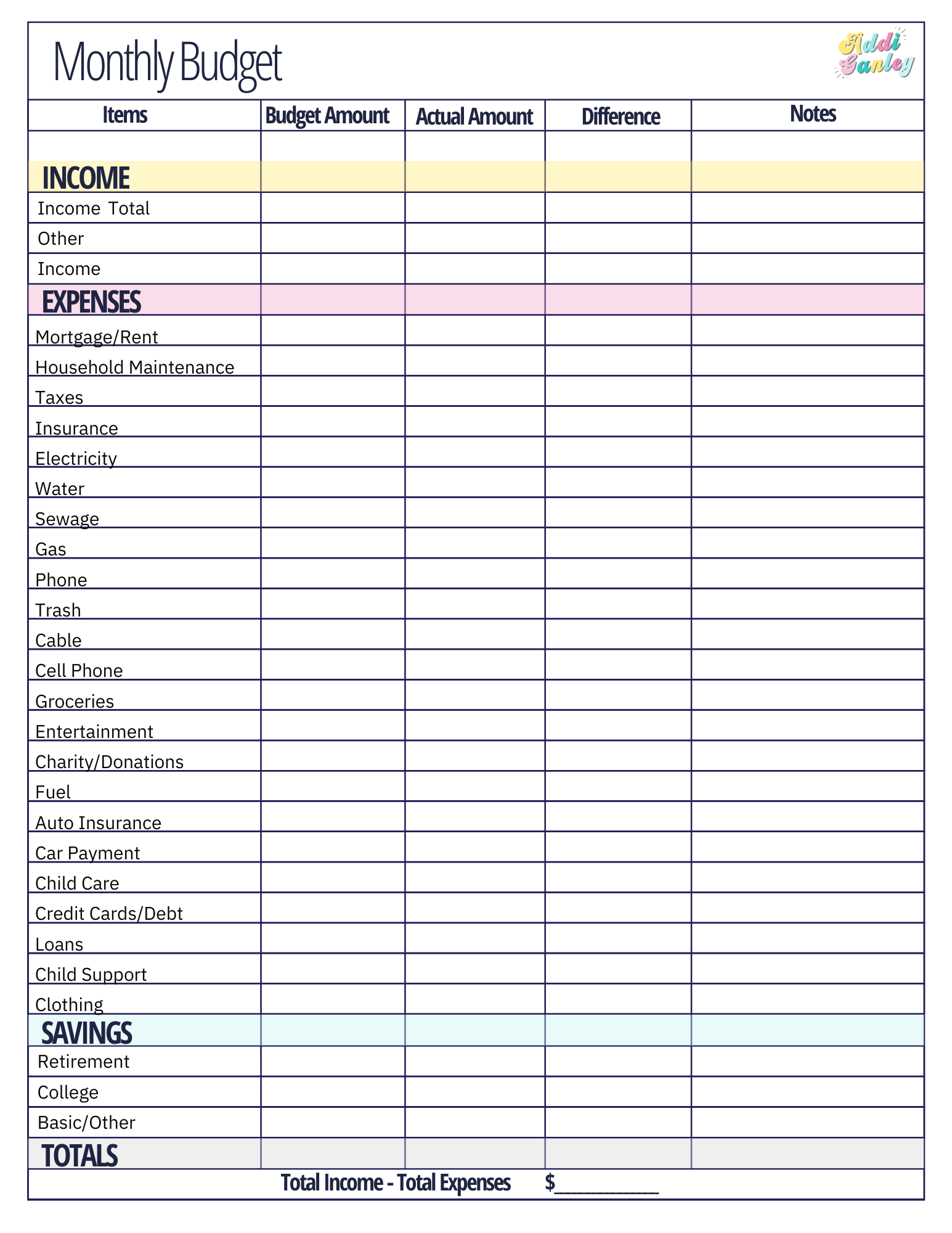

Image Source: canva.com

1. Gather Your Financial Information: Start by gathering your financial information, including your income sources, monthly bills, and any other financial commitments.

2. Choose a Monthly Budget Template: Select a monthly budget template that suits your needs and preferences. There are many free templates available online or you can create your own from scratch.

3. Input Your Financial Data: Fill in the template with your financial data, including your income sources, fixed expenses, variable expenses, savings goals, and any other relevant information.

4. Track Your Spending: Regularly update your monthly budget template with your actual expenses to track your spending habits and make adjustments as needed.

5. Review and Adjust: At the end of each month, review your budget template to see how you did. Make adjustments for the following month based on your spending patterns and financial goals.

Tips for Successful Budgeting with a Monthly Budget Template

To make the most of your budgeting efforts with a monthly budget template, here are some tips to help you stay on track and achieve your financial goals:

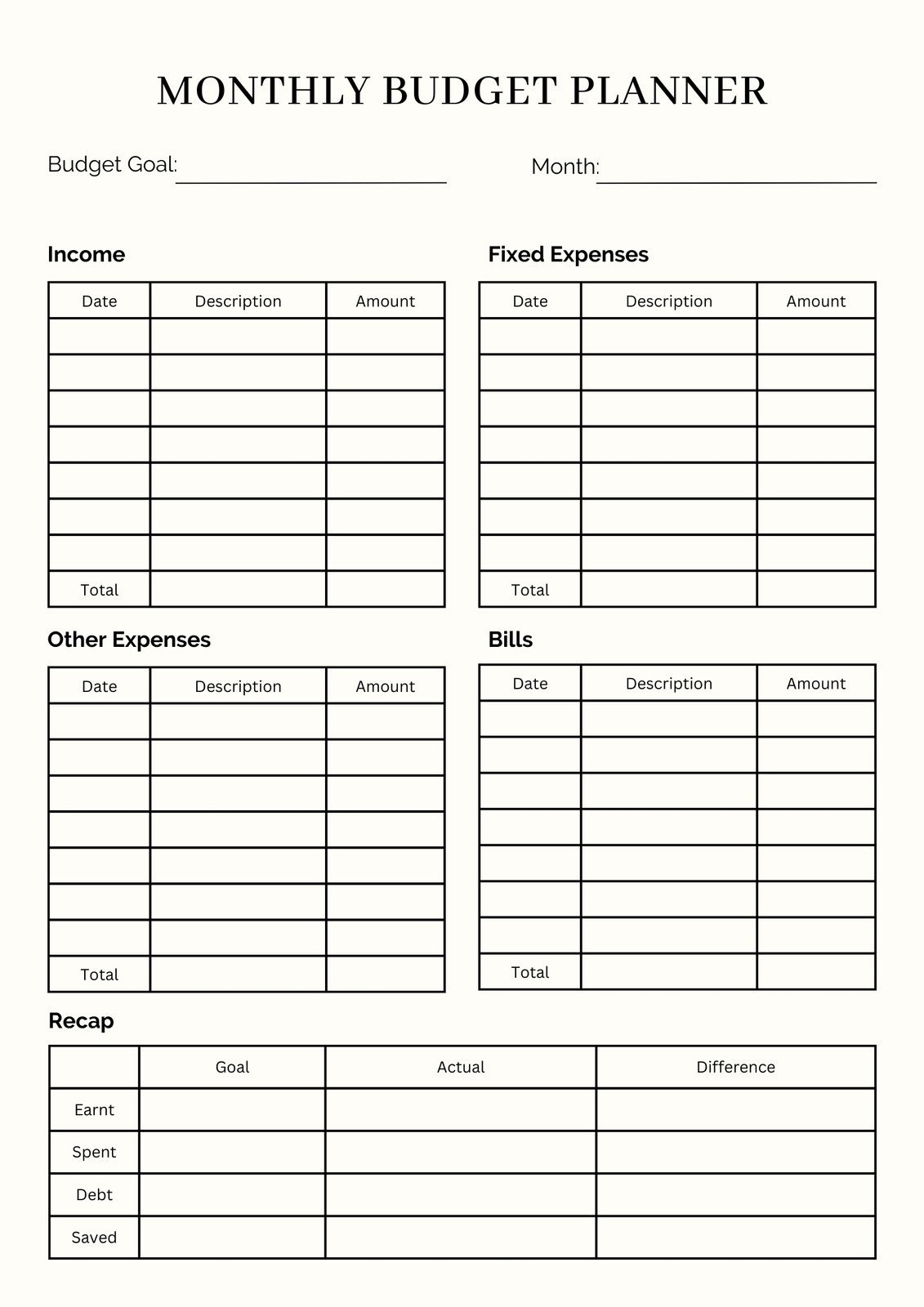

Image Source: canva.com

Be Realistic: Set realistic savings goals and budget for occasional splurges to avoid feeling restricted.

Track Your Expenses Regularly: Update your monthly budget template regularly to ensure accuracy and stay on top of your finances.

Automate Your Savings: Set up automatic transfers to your savings account to make saving money a priority.

Use Budgeting Apps: Consider using budgeting apps or tools to simplify the process and track your finances on the go.

Celebrate Your Wins: Reward yourself when you meet your savings goals or stick to your budget to stay motivated.

Seek Professional Help: If you are struggling with budgeting, consider seeking advice from a financial advisor or counselor to get back on track.

In conclusion, using a monthly budget template can be a powerful tool to help you take control of your finances, set realistic savings goals, and achieve financial freedom. By following the tips outlined in this article and staying consistent with your budgeting efforts, you can pave the way towards a more secure financial future. So why wait? Start using a monthly budget template today and watch your financial goals become a reality.

Image Source: squarespace-cdn.com

Image Source: canva.com