What is a Personal Net Worth Statement?

A personal net worth statement is a financial document that provides a snapshot of an individual’s financial position at a specific point in time. It is a summary of an individual’s assets, liabilities, and overall net worth. By calculating your net worth, you can gain a clear understanding of your financial health and track your progress toward your financial goals.

Creating a personal net worth statement involves listing all your assets (such as cash, investments, real estate, and personal property) and subtracting your liabilities (such as loans, mortgages, and credit card debts). The resulting figure is your net worth, which represents the value of your assets minus your liabilities.

A personal net worth statement is not only useful for individuals but also for businesses, as it helps assess the financial health of a company. It provides insights into how much an individual or a business is worth and serves as a valuable tool for financial planning and decision-making.

The Importance of a Personal Net Worth Statement

Creating a personal net worth statement offers several benefits:

- Financial Awareness: A personal net worth statement allows you to have a clear understanding of your financial situation. It helps you identify areas of strength and weakness, enabling you to make informed decisions about your finances.

- Goal Setting: By knowing your net worth, you can set realistic financial goals and track your progress toward achieving them. Whether it’s saving for retirement, paying off debt, or buying a house, a personal net worth statement provides a benchmark for measuring your financial success.

- Financial Planning: A personal net worth statement serves as a starting point for financial planning. It helps you evaluate your current financial position and make informed decisions about investments, savings, and debt management.

- Tracking Progress: Regularly updating your net worth statement allows you to track your financial progress over time. It helps you gauge the effectiveness of your financial strategies and make adjustments as needed.

How to Create a Personal Net Worth Statement

Creating a personal net worth statement involves a few simple steps:

- Gather Financial Information: Collect all relevant financial documents, including bank statements, investment statements, property deeds, loan statements, and credit card statements.

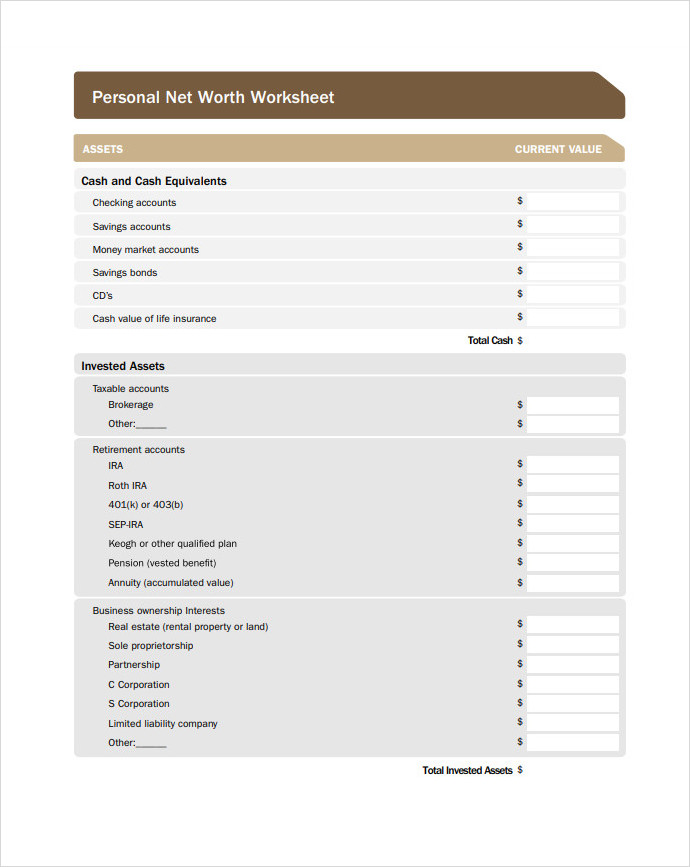

- List Your Assets: Make a comprehensive list of all your assets, including cash, savings accounts, investments, retirement accounts, real estate, vehicles, and valuable personal property.

- Assign Values to Your Assets: Assign a fair market value to each asset. For cash and investments, use the current balance. For real estate and vehicles, consider recent appraisals or market values.

- List Your Liabilities: Include all your debts, such as mortgages, loans, credit card balances, and outstanding bills.

- Calculate Your Net Worth: Subtract your total liabilities from your total assets to calculate your net worth.

- Update Regularly: Review and update your net worth statement regularly to reflect any changes in your financial situation.

What Does Your Personal Net Worth Statement Tell You?

Your net worth statement provides valuable insights into your financial health:

- Overall Financial Position: Your net worth represents your financial position at a given point in time. It tells you whether your assets outweigh your liabilities, indicating a positive financial standing.

- Progress Towards Financial Goals: By comparing your net worth over time, you can assess your progress toward achieving your financial goals. Increasing net worth indicates positive financial growth.

- Areas of Improvement: Your net worth statement highlights areas where you can improve your financial health. For example, a high level of debt compared to your assets may indicate the need to focus on debt reduction.

- Financial Decision-Making: Your net worth statement helps you make informed financial decisions. It provides a clear picture of your financial resources and obligations, enabling you to allocate funds wisely.

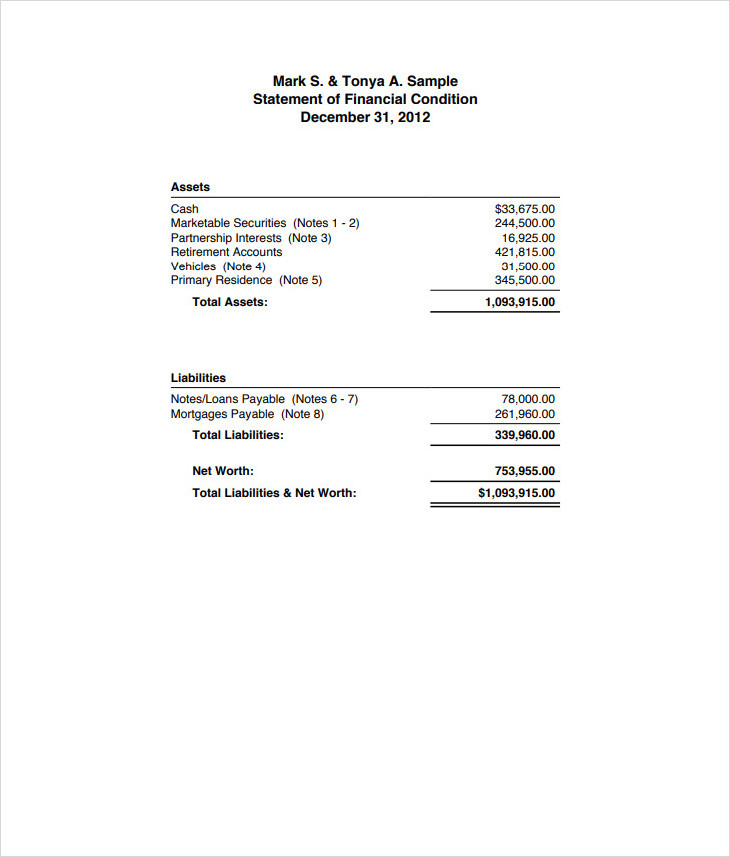

Sample Personal Net Worth Statement

Here is an example of how a personal net worth statement might look:

- Assets:

- Cash: $10,000

- Savings Account: $20,000

- Investment Portfolio: $50,000

- Real Estate: $200,000

- Vehicles: $30,000

- Personal Property: $10,000

- Liabilities:

- Mortgage: $150,000

- Auto Loan: $15,000

- Credit Card Debt: $5,000

- Student Loan: $20,000

- Net Worth: $130,000

Tips for Maximizing Your Net Worth

Here are some tips to help you increase your net worth:

- Save and Invest: Regularly save a portion of your income and invest it wisely. Consider diversifying your investments to minimize risk and maximize returns.

- Reduce Debt: Focus on paying off high-interest debts, such as credit cards and personal loans. Make additional payments whenever possible to reduce the principal amount.

- Control Spending: Track your expenses and identify areas where you can cut back. Create a budget and stick to it to ensure you are living within your means.

- Increase Income: Look for opportunities to increase your income, such as taking on a side job or freelancing. Use the additional income to pay down debt or invest.

- Review and Adjust: Regularly review your financial strategies and adjust them as needed. Stay informed about market trends and seek professional advice when necessary.

- Continuously Learn: Expand your financial knowledge through books, courses, and workshops. The more you know about personal finance, the better equipped you will be to make informed decisions.

- Set Realistic Goals: Set achievable financial goals and break them down into smaller milestones. Celebrate each milestone as you progress towards your larger objectives.

- Seek Professional Advice: If you feel overwhelmed or unsure about managing your finances, consider consulting a financial advisor who can provide personalized guidance.

Bottom Line

A personal net worth statement is a powerful tool for understanding your financial position and planning for the future. By regularly updating and analyzing your net worth, you can make informed decisions, track your progress toward financial goals, and work towards maximizing your wealth. Take control of your finances today by creating your net worth statement.

Take control of your financial planning with our Personal Net Worth Statement Template, ready for instant download. This template provides a comprehensive and customizable format for assessing your financial health by detailing your assets, liabilities, and net worth. With editable fields and clear instructions, it allows you to easily organize and track your financial information, empowering you to make informed decisions about investments, savings, and debt management. Download now to gain valuable insights into your financial situation and plan for a secure future.