As a self-employed individual, understanding profit and loss is crucial for managing your business finances effectively. Profit and loss statements, also known as income statements, provide a snapshot of your business’s financial performance over a specific period. By analyzing your profit and loss statement, you can assess the profitability of your business, identify areas of strength and weakness, and make informed decisions to improve your financial health.

What is Profit and Loss?

A profit and loss statement is a financial document that summarizes your business’s revenues, expenses, and net income over a specific period, such as a month, quarter, or year. The statement typically consists of three main components: revenues, expenses, and net income. Revenues represent the total income generated from sales or services, while expenses include all costs incurred to operate the business. Net income is calculated by subtracting total expenses from total revenues and indicates the profitability of the business during the period.

The Purpose of Profit and Loss Statements

Image Source: pdffiller.com

The primary purpose of a profit and loss statement is to provide an overview of your business’s financial performance and profitability. By analyzing the revenue and expense data presented in the statement, you can assess whether your business is generating a profit or incurring a loss. Profit and loss statements also help you track trends in your financial performance over time, identify areas where you can cut costs or increase revenue, and make informed decisions to improve your bottom line.

Why Profit and Loss Statements are Important for Self-Employed Individuals

For self-employed individuals, profit and loss statements play a crucial role in managing their business finances effectively. By regularly reviewing and analyzing their profit and loss statements, self-employed individuals can gain valuable insights into their business’s financial health and make strategic decisions to achieve their financial goals. Profit and loss statements help self-employed individuals track their business’s revenue and expenses, identify areas of inefficiency or overspending, and plan for future growth and expansion.

How to Create a Profit and Loss Statement

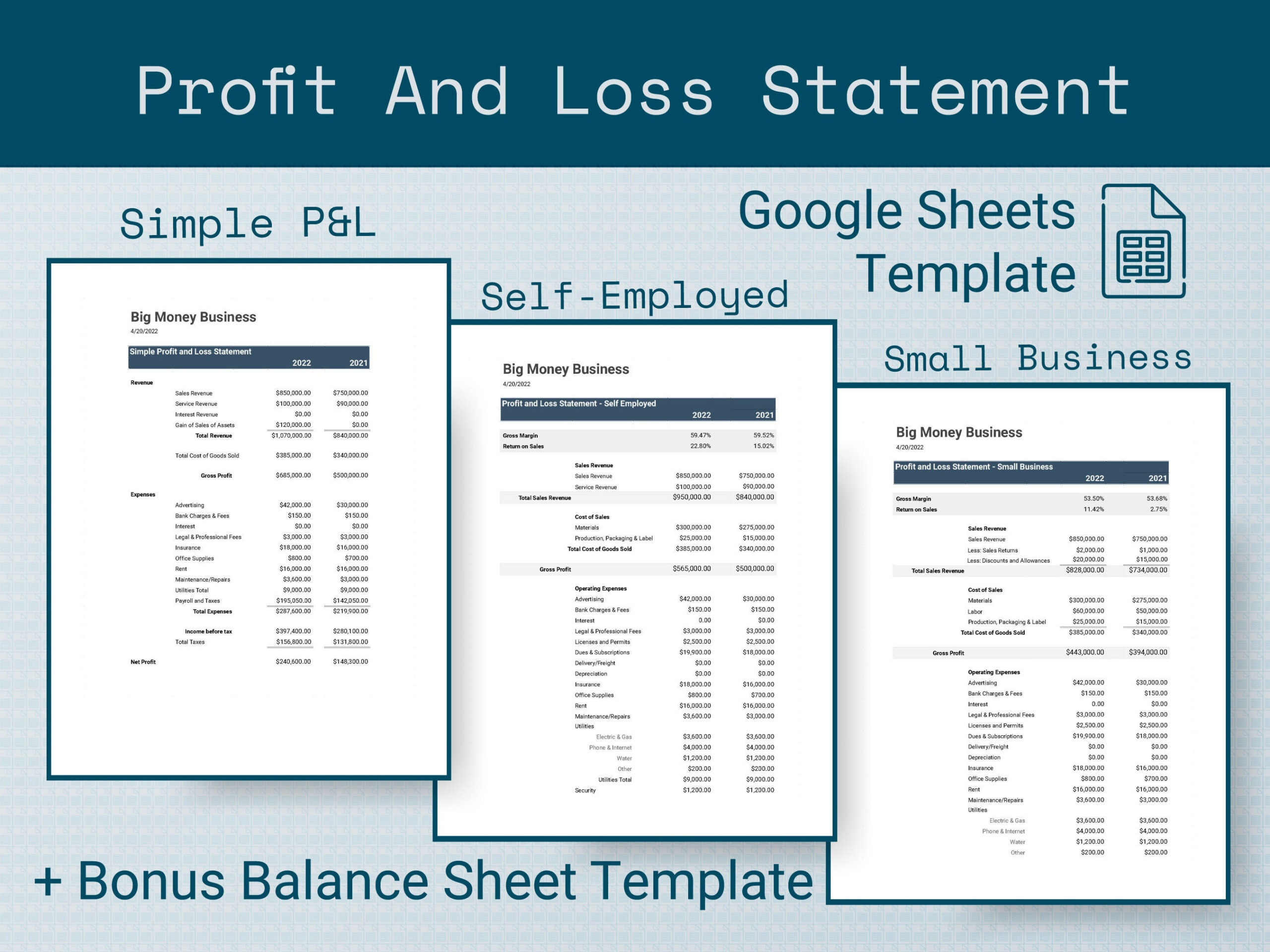

Image Source: etsystatic.com

Creating a profit and loss statement for your self-employed business is a relatively straightforward process. To generate a profit and loss statement, you will need to gather financial data from your business records, including sales receipts, invoices, and expense receipts. You can use accounting software or spreadsheet software to input this data and calculate your revenues, expenses, and net income. Once you have compiled all the necessary information, you can generate a profit and loss statement for the desired period, such as a month, quarter, or year.

1. Gather Financial Data

To create a profit and loss statement, start by gathering all relevant financial data from your business records, including income and expense receipts, invoices, and bank statements.

2. Calculate Revenues

Image Source: templatelab.com

Next, calculate your total revenues by summing up all income generated from sales or services during the specific period for which you are preparing the statement.

3. Determine Expenses

Identify and categorize all business expenses, including operating expenses, overhead costs, and other expenditures related to running your business.

4. Calculate Net Income

Image Source: spreadsheetpage.com

Subtract total expenses from total revenues to calculate your net income. A positive net income indicates a profit, while a negative net income signifies a loss.

5. Review and Analyze the Statement

Review your profit and loss statement to analyze your business’s financial performance, identify any trends or patterns, and make informed decisions to improve your profitability.

6. Make Strategic Decisions

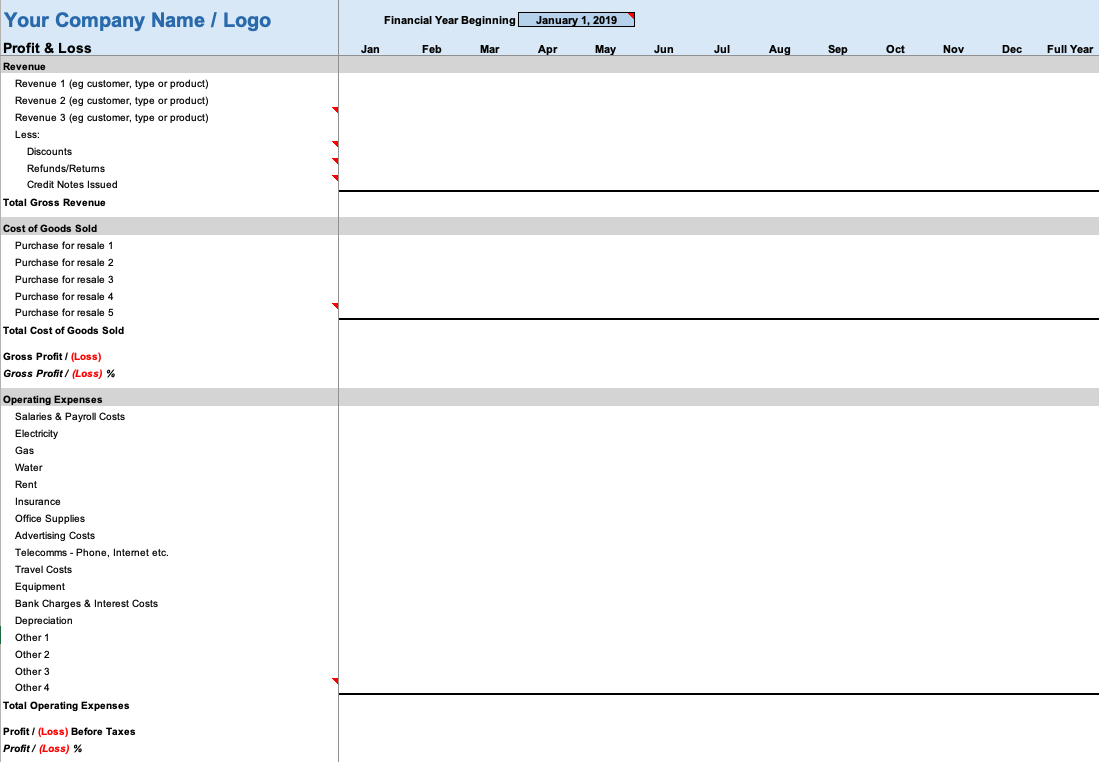

Image Source: pinimg.com

Use the insights gained from your profit and loss statement to make strategic decisions about your business operations, such as cutting costs, increasing prices, or expanding your product offerings.

7. Seek Professional Help if Needed

If you are unsure about creating or interpreting a profit and loss statement, consider seeking help from a financial advisor or accountant who can provide guidance and insights into your business’s financial health.

8. Regularly Monitor Your Financial Performance

Image Source: pdffiller.com

To ensure the financial health of your self-employed business, it is essential to regularly monitor your profit and loss statements, track key performance indicators, and make adjustments as needed to achieve your financial goals.

Tips for Successful Profit and Loss Management

Track Your Expenses: Keep detailed records of all your business expenses to accurately calculate your net income.

Monitor Your Cash Flow: Keep a close eye on your cash flow to ensure you have enough funds to cover expenses and invest in growth opportunities.

Set Realistic Financial Goals: Establish achievable financial goals for your business and track your progress using profit and loss statements.

Review Your Statement Regularly: Regularly review and analyze your profit and loss statements to identify trends, patterns, and areas for improvement.

Seek Professional Advice: If you are unsure about financial matters, don’t hesitate to seek help from a financial advisor or accountant.

Use Accounting Software: Consider using accounting software to automate the process of creating and analyzing profit and loss statements.

Image Source: pinimg.com

Image Source: spreadsheetpage.com

Image Source: amazonaws.com