Real estate profit and loss statement are essential tools for real estate investors to assess the financial health of their investments. By tracking revenue, expenses, and overall profitability, investors can make informed decisions about their properties and optimize their returns. In this article, we will delve into the intricacies of real estate profit and loss statements, exploring their purpose, importance, and how to effectively analyze them to maximize profit and minimize losses.

What is a Real Estate Profit and Loss Statement?

A real estate profit and loss statement, also known as an income statement, is a financial document that outlines the revenue, expenses, and overall profitability of a real estate investment property over a specific period. It provides a detailed breakdown of the property’s financial performance, helping investors understand how their investment is performing and identify areas for improvement.

The Purpose of a Real Estate Profit and Loss Statement

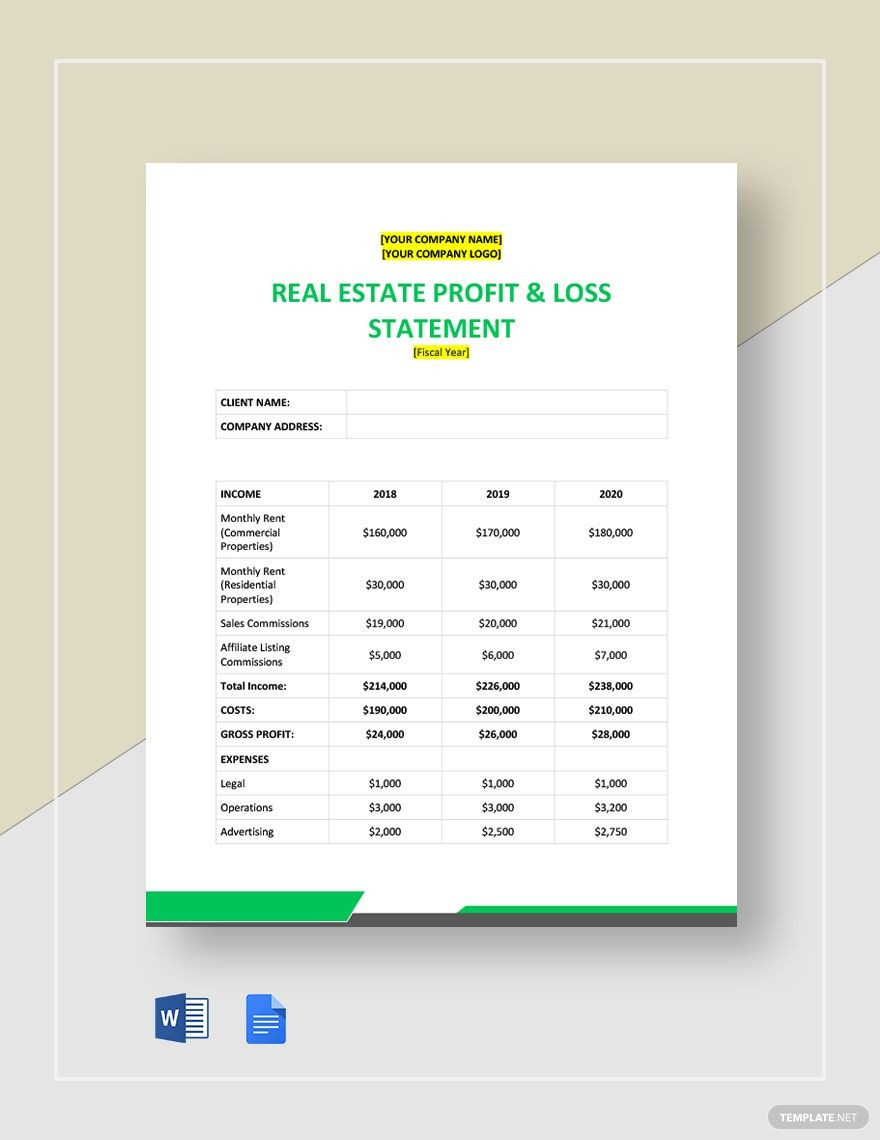

Image Source: templatelab.com

The primary purpose of a real estate profit and loss statement is to provide investors with a clear picture of their property’s financial performance. By analyzing the revenue and expenses associated with the property, investors can assess its profitability, identify trends, and make informed decisions about its management and future investments. Additionally, profit and loss statements are useful for tax purposes, financial planning, and securing financing for new real estate ventures.

Why Real Estate Investors Need Profit and Loss Statements

Real estate investors need profit and loss statements to track the financial health of their investments and make data-driven decisions. By monitoring revenue and expenses, investors can identify areas where costs can be reduced, revenues can be increased, and overall profitability can be optimized. Profit and loss statements also provide valuable insights into the performance of individual properties, allowing investors to allocate resources effectively and maximize returns.

How to Analyze a Real Estate Profit and Loss Statement

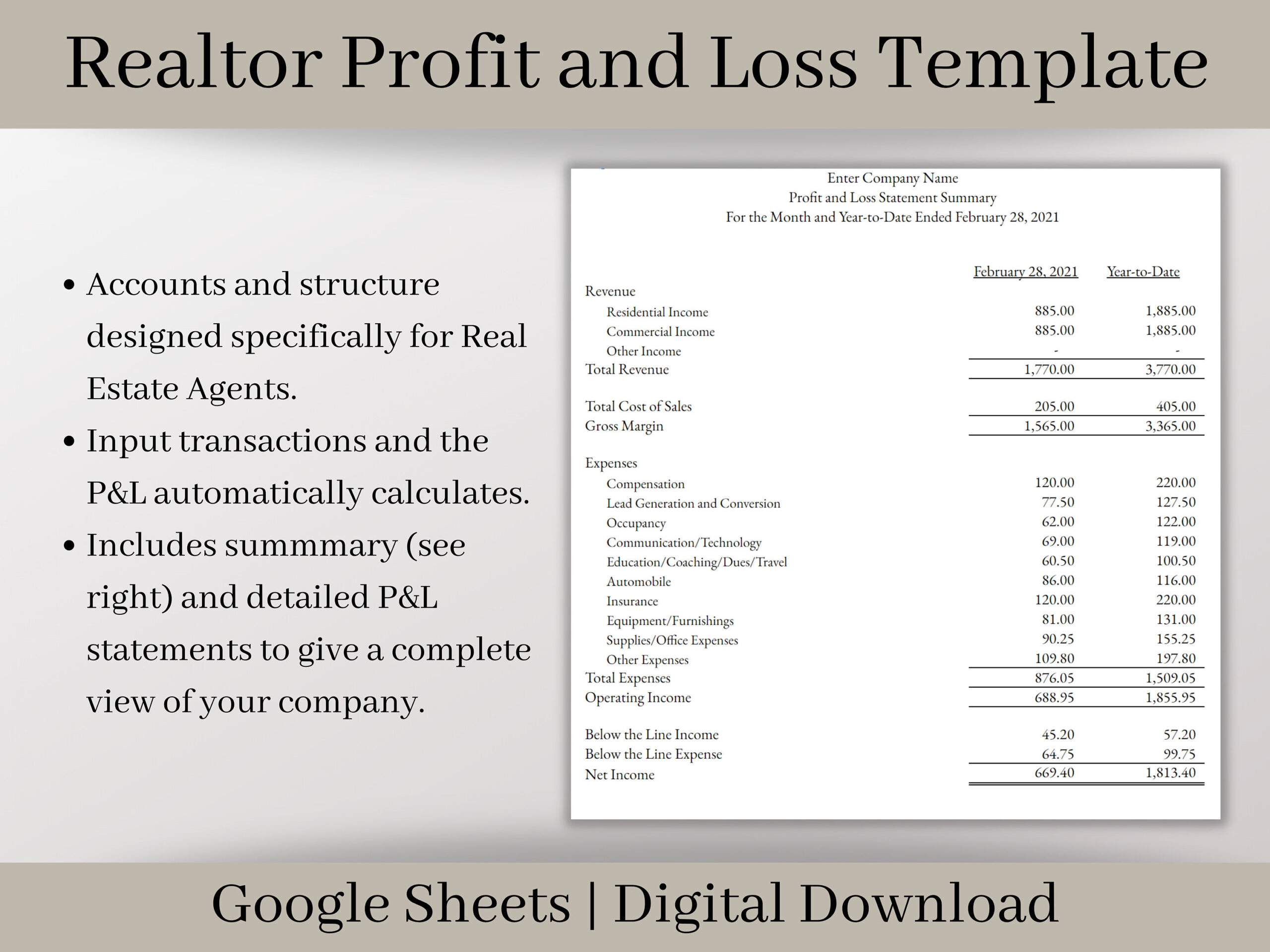

Image Source: template.net

Analyzing a real estate profit and loss statement involves examining key financial metrics, such as gross rental income, operating expenses, net operating income, and cash flow. By comparing these metrics to industry benchmarks and historical data, investors can identify trends, anomalies, and areas for improvement. Additionally, investors should pay attention to non-operating expenses, such as financing costs and depreciation, to get a comprehensive view of the property’s financial performance.

1. Calculate Gross Rental Income

To calculate gross rental income, sum up all the rental income generated by the property over a specific period. This includes rent from tenants, parking fees, laundry income, and any other sources of revenue related to the property.

2. Deduct Operating Expenses

Image Source: template.net

Operating expenses include property management fees, maintenance costs, property taxes, insurance premiums, utilities, and other expenses necessary to operate the property. Deducting these expenses from gross rental income gives you the property’s net operating income.

3. Evaluate Net Operating Income

Net operating income (NOI) is a key metric that indicates the property’s profitability before accounting for financing costs and taxes. A high NOI signifies a profitable investment, while a low NOI may indicate inefficiencies in operations or excessive expenses.

4. Assess Cash Flow

Image Source: pinimg.com

Cash flow is the amount of money generated by the property after all expenses, including financing costs, have been deducted. Positive cash flow indicates that the property is generating more income than it costs to operate, while negative cash flow may signal financial trouble.

5. Compare Performance Metrics

To evaluate the property’s financial performance, compare key metrics such as gross rental income, operating expenses, NOI, and cash flow to industry averages and historical data. This analysis can help you identify areas where the property is underperforming and develop strategies to improve profitability.

6. Identify Areas for Improvement

Image Source: etsystatic.com

After analyzing the profit and loss statement, identify areas where costs can be reduced, revenues can be increased, and overall profitability can be optimized. This may involve renegotiating contracts with vendors, increasing rental rates, improving property management practices, or implementing cost-saving measures.

7. Make Informed Decisions

Armed with the insights from the profit and loss statement, make informed decisions about the property’s management, financing, and future investments. Use the data to develop a strategic plan for maximizing profitability, mitigating risks, and achieving your financial goals as a real estate investor.

8. Seek Professional Advice

Image Source: etsystatic.com

If analyzing profit and loss statements seems overwhelming or if you’re unsure about your financial decisions, seek advice from financial advisors, real estate professionals, or accountants. They can provide valuable insights, guidance, and expertise to help you navigate the complexities of real estate investing and optimize your returns.

Tips for Successful Real Estate Profit and Loss Analysis

Regularly Review Your Profit and Loss Statements. Schedule regular reviews of your profit and loss statements to track the financial performance of your properties and make timely adjustments.

Use Industry Benchmarks. Compare your property’s financial metrics to industry benchmarks to assess its performance relative to competitors and identify areas for improvement.

Monitor Cash Flow Closely. Keep a close eye on your property’s cash flow to ensure that it remains positive and sustainable in the long run.

Invest in Property Management. Consider hiring a professional property management company to handle day-to-day operations, maintenance, and tenant relations to optimize profitability.

Stay Informed About Market Trends. Stay updated on market trends, economic conditions, and regulatory changes that may impact your real estate investments and adjust your strategies accordingly.

Diversify Your Portfolio. Diversify your real estate portfolio to spread risks, maximize returns, and take advantage of different market opportunities.

In conclusion, real estate profit and loss statements are indispensable tools for real estate investors to assess the financial performance of their properties, make informed decisions, and maximize profitability. By analyzing key financial metrics, identifying areas for improvement, and seeking professional advice when needed, investors can optimize their returns and achieve long-term success in the competitive real estate market.