If you’re self-employed, keeping track of your earnings and expenses for tax is crucial. A self-employment ledger can help you better manage your finances and optimize your tax refund. By maintaining a self-employment ledger, you’ll have proof of all your earnings and expenses regarding tax season. Additionally, every eligible business expense you record in your ledger can help reduce your taxes.

In this article, we’ll explore the benefits of using a self-employment ledger, how to create one, and provide some practical tips for successful ledger management.

What is a Self-Employment Ledger?

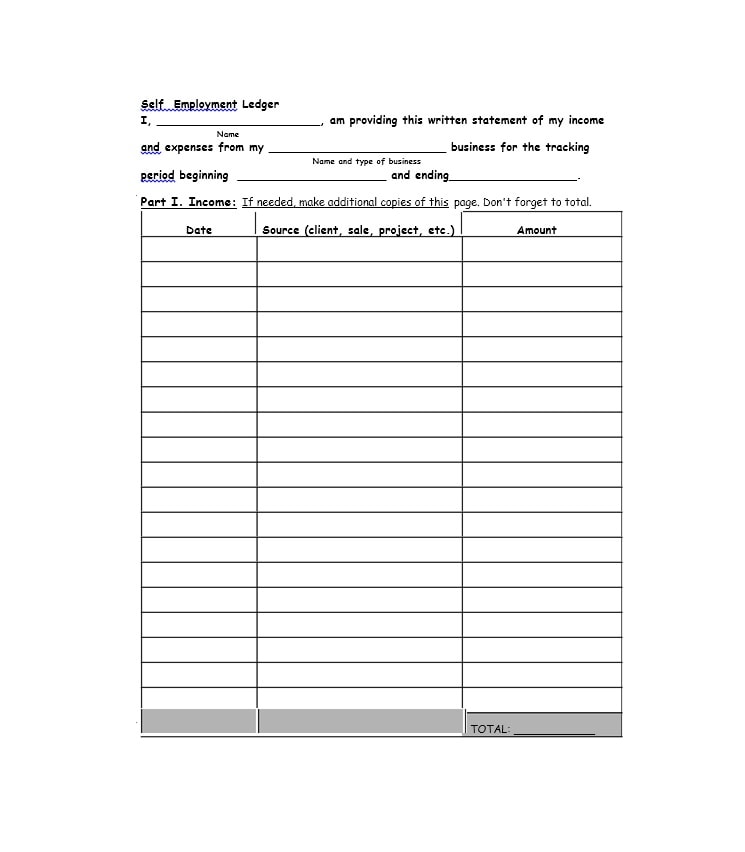

A self-employment ledger is a document that allows self-employed individuals to record their business income and expenses. It serves as a comprehensive record of your financial transactions, making it easier to track and manage your finances.

By keeping a self-employment ledger, you’ll have all the necessary information readily available to complete your tax return accurately and optimize your tax refund.

Why Use a Self-Employment Ledger?

There are several reasons why using a self-employment ledger is beneficial for self-employed individuals:

- Accurate Recordkeeping: A self-employment ledger helps you maintain accurate records of your income and expenses. This is crucial for tax purposes and can also be useful for financial planning and analysis.

- Tax Optimization: By tracking your business expenses in a self-employment ledger, you can identify eligible deductions and reduce your taxable income. This, in turn, helps optimize your tax refund.

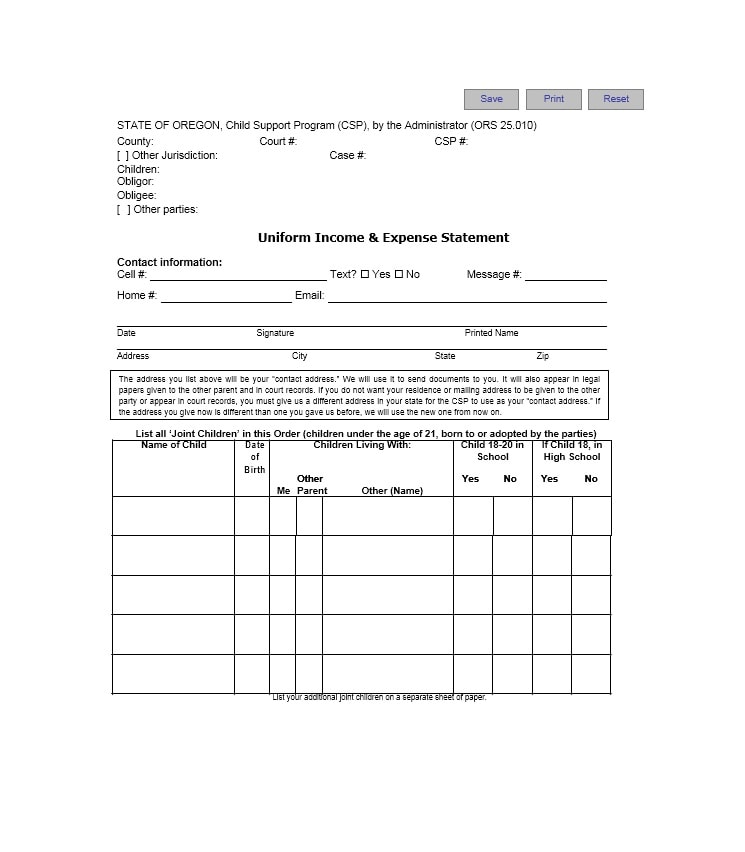

- Proof of Income: A self-employment ledger serves as proof of your earnings, which may be required for various purposes, such as applying for loans or renting an apartment.

- Business Insights: Regularly reviewing your self-employment ledger can provide valuable insights into your business’s financial health. You can identify trends, evaluate profitability, and make informed decisions based on the data.

How to Create a Self-Employment Ledger

Creating a self-employment ledger is relatively straightforward.

Here’s a step-by-step guide to help you get started:

1. Choose a Format

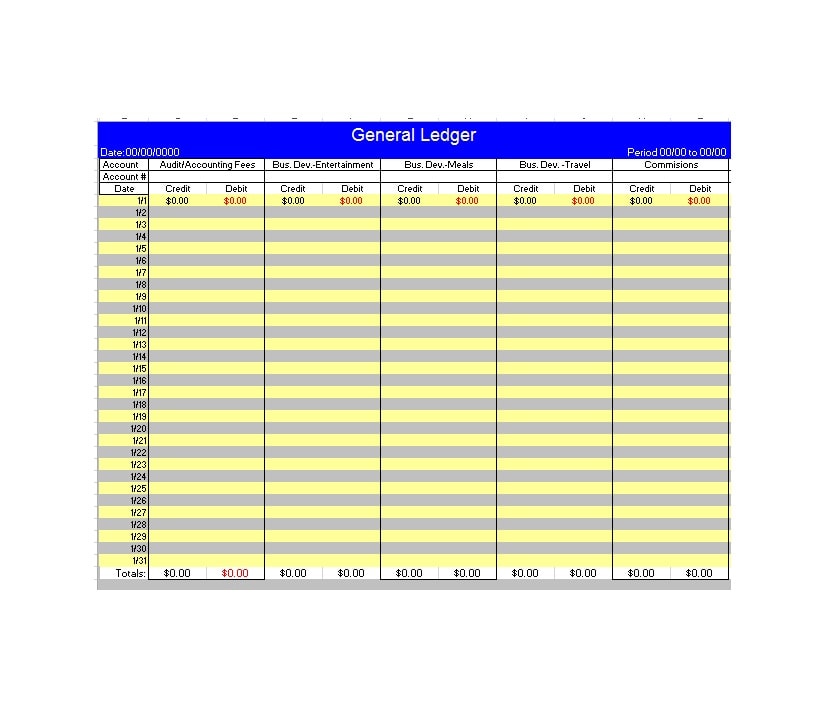

You can create a self-employment ledger using spreadsheet software like Microsoft Excel or Google Sheets. Alternatively, you can use templates available online. Choose a format that suits your preferences and needs.

2. Set Up Columns

In your chosen format, set up columns to capture the necessary information. Typically, you’ll need columns for the date of the transaction, the description of the transaction, income, and expenses.

3. Record Transactions Regularly

Make it a habit to record your business transactions regularly. Set aside dedicated time each week or month to update your self-employment ledger. This ensures that you don’t miss any income or expense entries and keeps your records up to date.

4. Categorize Expenses

Categorize your expenses into relevant categories such as office supplies, travel expenses, advertising costs, etc. This helps you identify deductions more easily and provides a clear picture of your business expenses.

5. Calculate Totals

At the end of each month or year, calculate the totals for your income and expenses. This will give you an overview of your business’s financial performance and assist you in preparing your tax return.

6. Store Supporting Documents

Keep all supporting documents, such as receipts and invoices, organized and easily accessible. These documents serve as evidence for the transactions recorded in your self-employment ledger.

Examples

Tips for Successful Self-Employment Ledger Management

Managing your self-employment ledger effectively can help streamline your financial processes and ensure accurate records. Here are some tips to help you succeed:

- Be Consistent: Make it a habit to update your self-employment ledger regularly. Consistency is key to maintaining accurate records and preventing any lapses.

- Organize Supporting Documents: Keep all receipts, invoices, and other supporting documents organized. This makes it easier to reconcile your ledger entries and provides evidence for your transactions.

- Separate Business and Personal Finances: Maintain separate bank accounts and credit cards for your business and personal finances. This simplifies the recording and tracking of business transactions.

- Consult with a Tax Professional: If you’re unsure about certain tax regulations or need guidance on maximizing deductions, consider consulting with a tax professional. They can provide valuable advice tailored to your specific situation.

- Review and Analyze Regularly: Take the time to review and analyze your self-employment ledger periodically. Look for trends, identify areas for improvement, and make informed financial decisions based on the data.

- Backup Your Data: Regularly back up your self-employment ledger data to prevent any loss or corruption. Store backups in secure locations, such as cloud storage or external hard drives.

Conclusion

A self-employment ledger is a valuable tool for self-employed individuals to manage their finances and optimize their tax refund. By keeping a self-employment ledger, you can track your earnings and expenses, reduce your taxable income through eligible deductions, and have all the necessary documentation ready for tax season.

Follow the steps outlined in this article to create your self-employment ledger and implement the tips provided for successful ledger management. By doing so, you’ll have better control over your finances and make informed financial decisions for your business.

Self-Employment Ledger Template – Download