Creating a simple home budget template can be a game-changer when it comes to managing your finances effectively. Whether you are looking to save more money, pay off debt, or just have better control over your spending, a budget template can provide you with a clear roadmap to achieve your financial goals. By tracking your income, expenses, and savings in a structured way, you can make informed decisions about where your money is going and where you can make adjustments. In this article, we will discuss the purpose of a home budget template, why it is important, how to create one, and provide tips for successful budgeting.

What is a Home Budget Template?

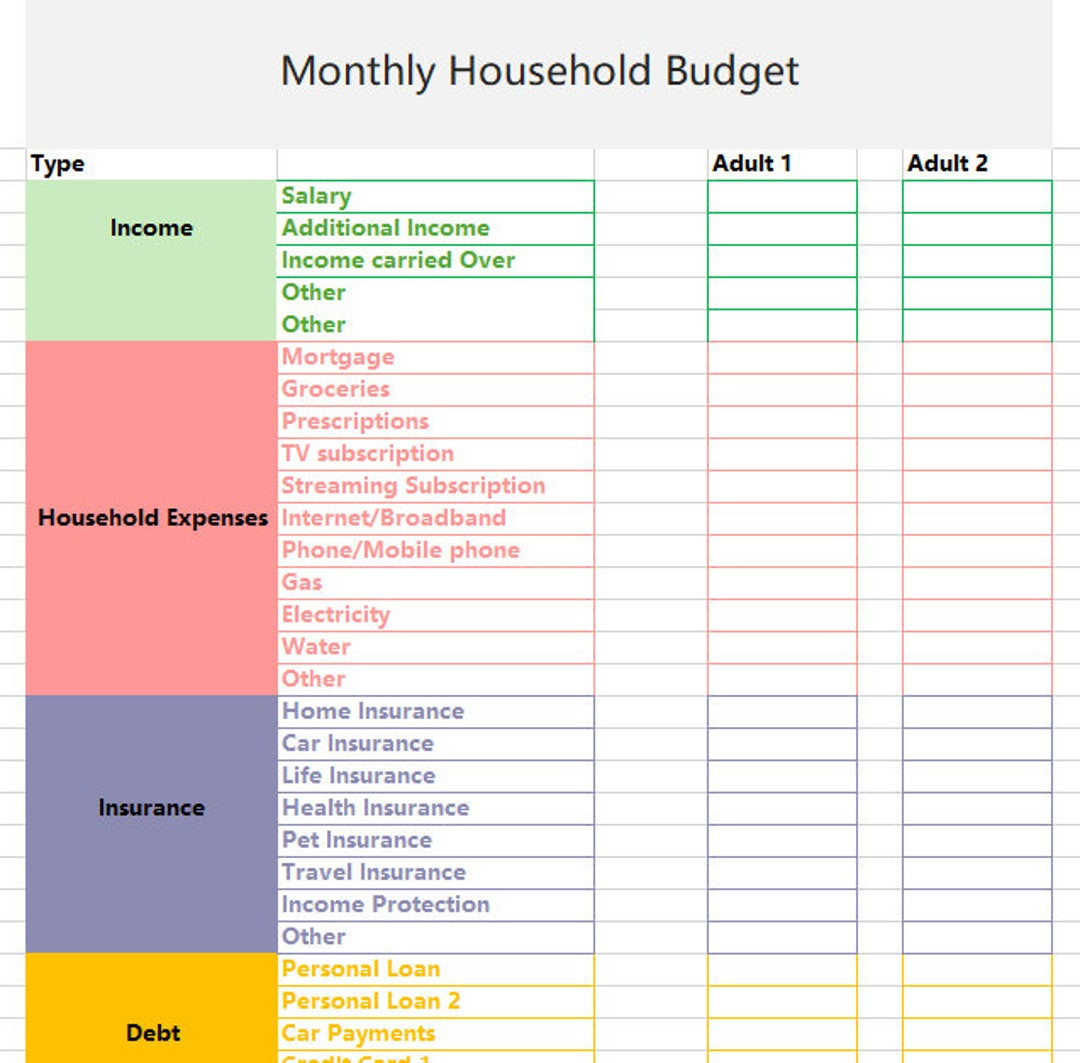

A home budget template is a tool that helps you track your income, expenses, and savings on a regular basis. It typically includes categories for different types of expenses such as housing, transportation, groceries, entertainment, and more. By inputting your financial information into the template, you can see a snapshot of your overall financial picture, identify areas where you may be overspending, and make adjustments to reach your financial goals.

The Purpose of a Home Budget Template

Image Source: smartsheet.com

The main purpose of a home budget template is to provide you with a clear overview of your finances. By tracking your income and expenses, you can see where your money is going and make informed decisions about how to allocate it. A budget template can help you identify areas where you can cut back on spending, increase your savings, or pay off debt. It can also help you set financial goals and track your progress towards achieving them.

Why You Need a Home Budget Template

Creating a home budget template is essential for anyone who wants to take control of their finances. Without a clear understanding of where your money is going, it is easy to overspend, accumulate debt, and struggle to reach your financial goals. A budget template can help you track your spending, identify areas where you can save money, and make smarter decisions about your finances. It can also help you plan for unexpected expenses, save for future goals, and build a strong financial foundation for the future.

How to Create a Home Budget Template

Image Source: pinimg.com

Creating a home budget template is easier than you might think. Here are some steps to get you started:

1. List all sources of income: Start by listing all of your sources of income, including your salary, bonuses, side hustle income, and any other money you receive on a regular basis.

2. Track your expenses: Next, track all of your expenses for a month. This includes everything from rent or mortgage payments to groceries, utilities, entertainment, and more.

3. Categorize your expenses: Organize your expenses into categories such as housing, transportation, groceries, entertainment, and savings.

4. Set financial goals: Determine what your financial goals are, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

5. Allocate your income: Allocate your income to cover your expenses, savings goals, and any debt payments.

6. Monitor and adjust: Regularly monitor your budget template and make adjustments as needed to stay on track with your financial goals.

Tips for Successful Budgeting

Successfully sticking to a budget requires discipline and consistency. Here are some tips to help you stay on track with your budget:

Image Source: canva.com

Track your spending: Keep a record of all your expenses to see where your money is going.

Set realistic goals: Make sure your financial goals are achievable and adjust them as needed.

Automate your savings: Set up automatic transfers to your savings account to make saving easier.

Avoid unnecessary expenses: Cut back on unnecessary spending to free up more money for savings or debt repayment.

Review and adjust regularly: Regularly review your budget and make adjustments as needed to stay on track with your financial goals.

Reward yourself: Celebrate small wins along the way to stay motivated and encouraged on your financial journey.

In conclusion, creating a simple home budget template is a powerful tool for taking control of your finances and reaching your financial goals. By tracking your income, expenses, and savings in a structured way, you can make informed decisions about your money and achieve financial success. Follow the steps outlined in this article and incorporate the tips for successful budgeting to set yourself up for financial stability and success.

Image Source: canva.com

Image Source: canva.com

Image Source: smartsheet.com

Image Source: generalblue.com

Image Source: canva.com

Image Source: amomstake.com

Image Source: etsystatic.com