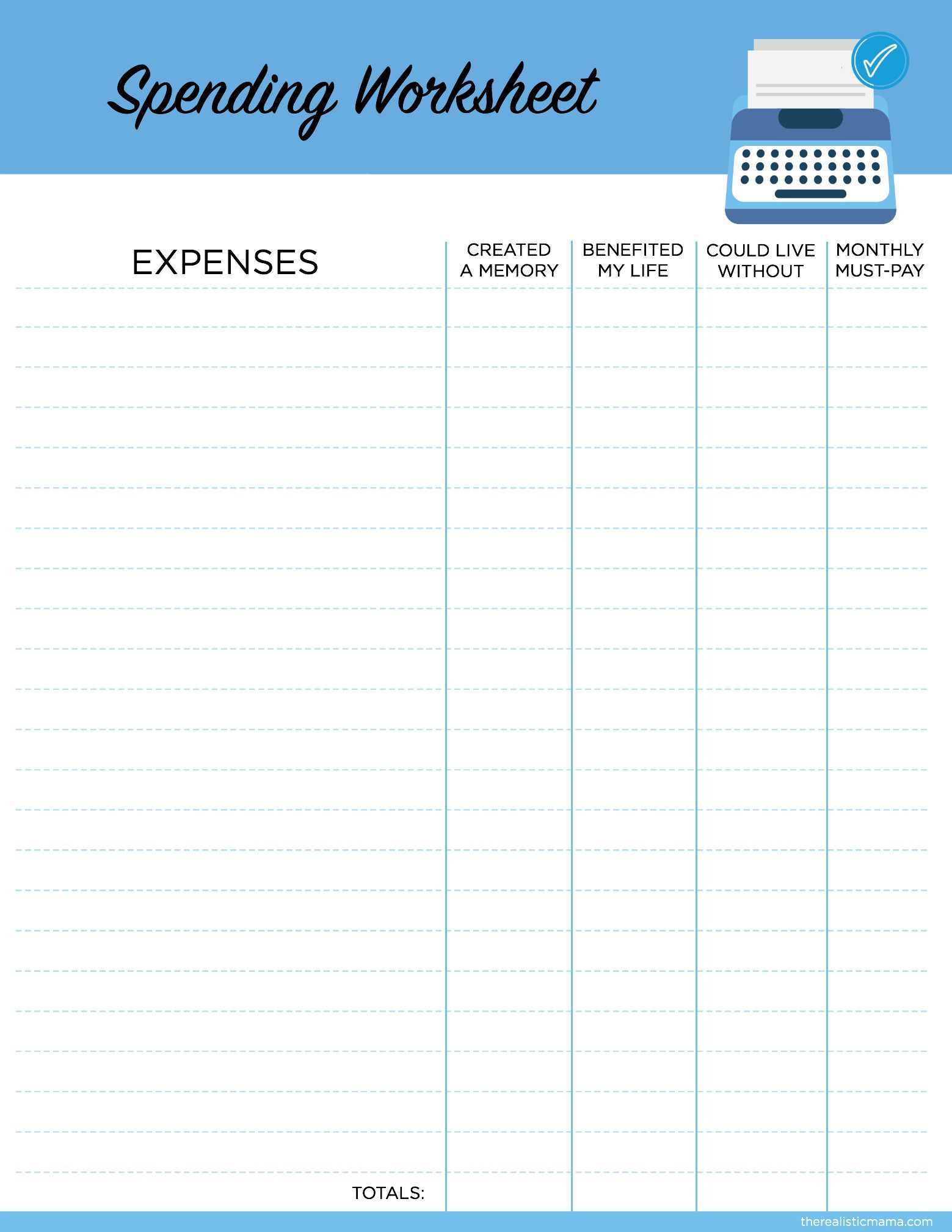

A spending and saving worksheet, also known as a budget worksheet, is a tool that helps you track and evaluate your income, expenses, and savings. It provides a structured way to organize your financial information and gain a clear understanding of your financial situation.

By using a spending and saving worksheet, you can effectively manage your money, control your spending, and build healthier financial habits.

Why Use a Spending and Saving Worksheet?

The purpose of a spending and saving worksheet is to help you control your spending and build healthier financial habits.

Here are some reasons why using a budget worksheet is beneficial:

1. Financial Awareness: A spending and saving worksheet allows you to see your income, expenses, and savings in one place. It helps you gain a clear understanding of your financial situation and identify areas where you can make improvements.

2. Expense Tracking: With a budget worksheet, you can track your expenses and see where your money is going. This helps you identify unnecessary expenses and make adjustments to your spending habits.

3. Goal Setting: A spending and saving worksheet allows you to set financial goals and track your progress toward achieving them. Whether you want to save for a vacation, pay off debt, or build an emergency fund, a budget worksheet helps you stay focused and motivated.

4. Budgeting: By using a budget worksheet, you can create a realistic budget that aligns with your income and financial goals. It helps you allocate your money wisely and avoid overspending.

5. Debt Management: A spending and saving worksheet helps you keep track of your debts and develop a plan to pay them off. It allows you to prioritize your debts and make extra payments towards high-interest loans.

6. Savings Planning: With a budget worksheet, you can effectively plan and track your savings. It helps you set aside money for emergencies, retirement, and other long-term financial goals.

How to Use a Spending and Saving Worksheet?

Using a spending and saving worksheet is simple.

Here are the steps to follow:

1. Download or Create a Worksheet: You can find spending and saving worksheets online or create your own using a spreadsheet program like Microsoft Excel or Google Sheets.

2. Gather Financial Information: Collect all your financial information, including income sources, expenses, debts, and savings. This will help you fill in the worksheet accurately.

3. Categorize Your Income and Expenses: Divide your income and expenses into categories such as housing, transportation, groceries, entertainment, and debt payments. This will help you organize your financial information and track your spending.

4. Fill in the Worksheet: Enter your income, expenses, debts, and savings in the appropriate sections of the worksheet. Be as detailed as possible to get an accurate picture of your finances.

5. Evaluate Your Financial Situation: Once you have filled in the worksheet, evaluate your financial situation. Look for areas where you can cut back on expenses or increase your savings.

6. Set Goals and Make Adjustments: Based on your financial evaluation, set realistic goals and make adjustments to your spending and saving habits. This could include reducing expenses, increasing income, or reallocating funds to prioritize your financial goals.

7. Track Your Progress: Regularly update your spending and saving worksheet to track your progress towards your financial goals. This will help you stay on track and make necessary adjustments along the way.

Examples

Tips for Successful Use of a Spending and Saving Worksheet

To make the most out of your spending and saving worksheet, here are some tips for successful use:

- Be Honest: When filling in the worksheet, be honest about your income, expenses, and savings. This will give you an accurate picture of your financial situation.

- Track Every Expense: Record every expense, no matter how small. This will help you identify areas where you can cut back and save money.

- Review Regularly: Regularly review your spending and saving worksheet to track your progress and make adjustments. This will help you stay on top of your finances.

- Set Realistic Goals: Set realistic financial goals that are achievable within your current income and expenses. This will keep you motivated and focused on improving your financial situation.

- Seek Professional Advice: If you’re struggling with your finances or need guidance, consider consulting a financial advisor. They can provide personalized advice and help you create a budget that works for you.

- Be Flexible: Financial situations can change, so be flexible with your spending and saving worksheet. Update it regularly to reflect any changes in your income, expenses, or goals.

- Celebrate Milestones: Celebrate your financial milestones, whether it’s paying off a debt or reaching a savings goal. This will keep you motivated and encouraged to continue improving your financial habits.

In Conclusion

A spending and saving worksheet is a valuable tool for managing your finances and building healthier financial habits. By using a budget worksheet, you can track your income, expenses, and savings, control your spending, and work towards your financial goals.

Remember to be honest, track every expense, and regularly review and adjust your worksheet to stay on top of your finances. With the right approach and commitment, a spending and saving worksheet can help you achieve financial control and peace of mind.

Spending And Saving Worksheet Template – Download