Starting a new business can be an exhilarating experience, filled with endless possibilities and dreams of success. However, one of the most crucial aspects of getting a startup off the ground is creating a solid budget plan. A startup company budget template is a valuable tool that can help entrepreneurs effectively manage their finances, track expenses, and make informed decisions about the future of their business.

What is a Startup Company Budget Template?

A startup company budget template is a pre-designed document that outlines the financial plan for a new business. It typically includes sections for revenue projections, expense forecasts, cash flow analysis, and financial goals. By using a budget template, entrepreneurs can easily input their financial data, track their progress, and make adjustments as needed. This tool serves as a roadmap for the financial health of the business and helps ensure that resources are allocated efficiently.

The Purpose of a Startup Company Budget Template

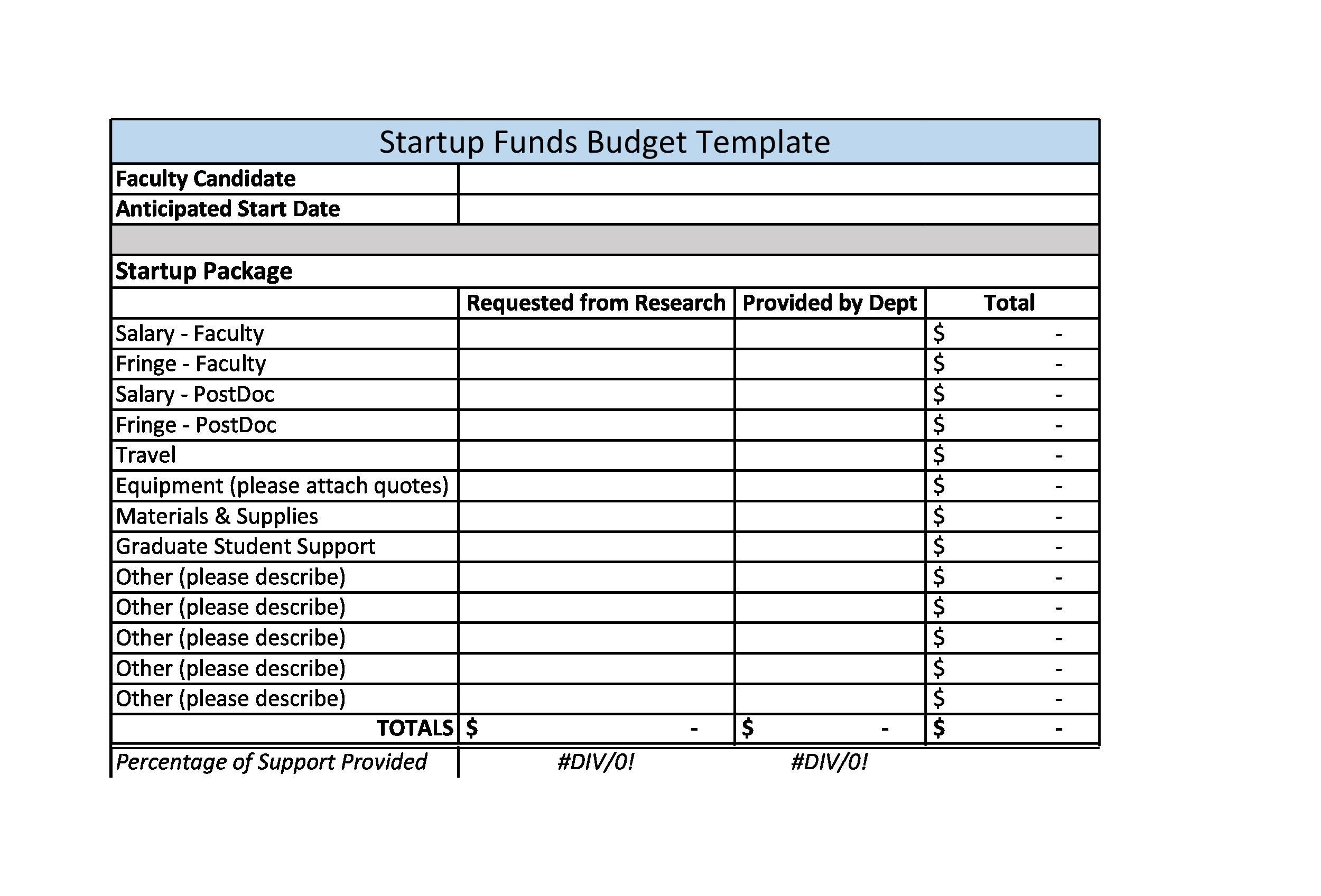

Image Source: templatelab.com

The primary purpose of a startup company budget template is to help entrepreneurs effectively manage their finances and make informed decisions about the future of their business. By creating a budget plan, business owners can set realistic financial goals, track their progress, and identify areas where costs can be reduced or revenue increased. Additionally, a budget template can help entrepreneurs secure funding from investors or lenders by demonstrating a clear understanding of their financial needs and objectives.

Why You Need a Startup Company Budget Template

Creating a budget plan is essential for the success of any business, but it is especially critical for startups. Without a clear financial roadmap, entrepreneurs may find themselves overspending, running out of cash, or making uninformed decisions that can jeopardize the future of their business. A startup company budget template provides a structured framework for managing finances, setting goals, and making strategic decisions that can help the business thrive in the long run.

How to Create a Startup Company Budget Template

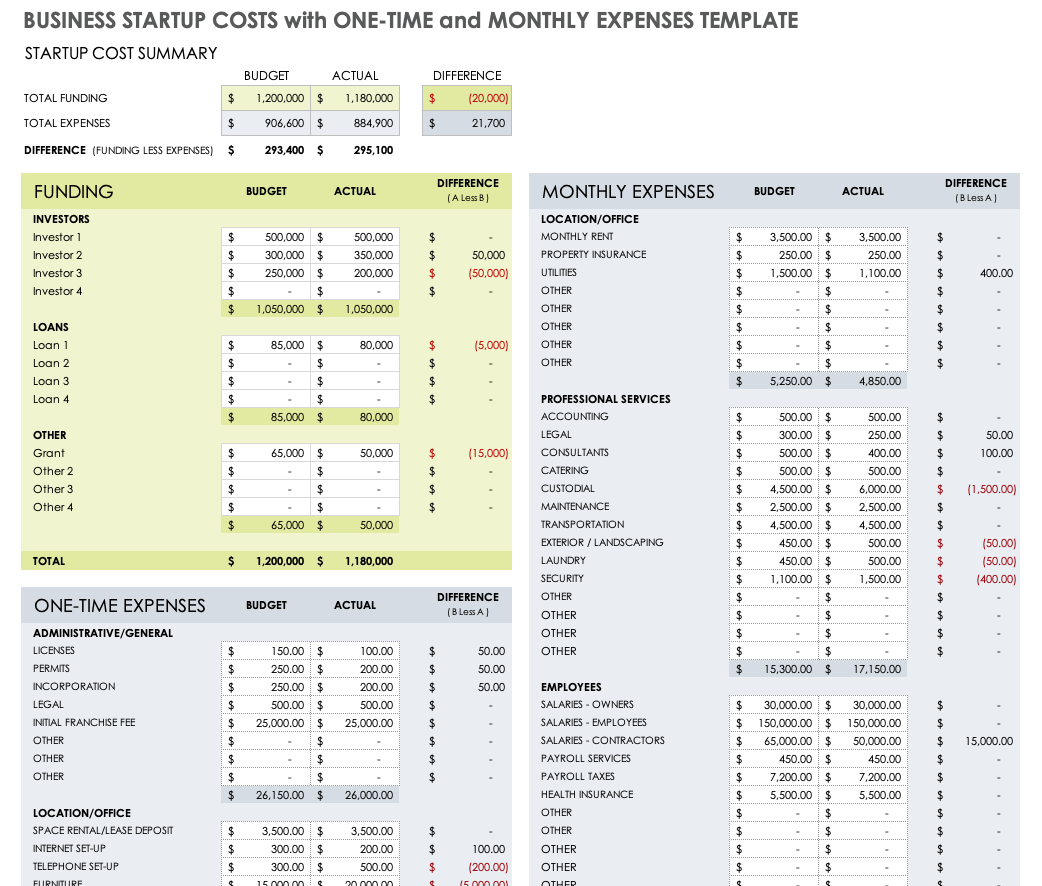

Image Source: templatelab.com

When creating a startup company budget template, it is important to start by gathering all relevant financial information, including revenue projections, expenses, and cash flow estimates. Next, entrepreneurs should determine their financial goals and objectives, such as breaking even, reaching profitability, or securing funding. Once the data is collected, it can be inputted into the budget template, which should include sections for income, expenses, capital expenditures, and cash flow analysis. Regularly updating and reviewing the budget plan is crucial for ensuring its effectiveness and making adjustments as needed.

Tips for Successful Budgeting

Set Realistic Goals: When creating a budget plan, it is important to set achievable financial goals that align with the overall objectives of the business.

Track Expenses Closely: Monitoring expenses closely can help identify areas where costs can be reduced and resources allocated more efficiently.

Review and Update Regularly: Regularly reviewing and updating the budget plan is essential for staying on track and making informed decisions about the financial health of the business.

Seek Professional Advice: If you are unsure about creating a budget plan, consider seeking advice from a financial advisor or accountant who can provide guidance and expertise.

Be Flexible: It is important to be flexible and willing to adjust the budget plan as needed to adapt to changing market conditions or unexpected circumstances.

Monitor Cash Flow: Keeping a close eye on cash flow is crucial for ensuring that the business has enough liquidity to cover expenses and operate smoothly.

Image Source: templatelab.com

In conclusion, a startup company budget template is an essential tool for entrepreneurs looking to effectively manage their finances and make informed decisions about the future of their business. By creating a budget plan, setting realistic goals, and regularly reviewing and updating the financial data, startups can increase their chances of success and thrive in a competitive market.

Image Source: smartsheet.com

Image Source: gusto-assets.com

Image Source: cloudinary.com

Image Source: smartsheet.com

Image Source: smartsheet.com

Image Source: smartsheet.com