Managing the payroll process can be a challenging task for any organization. It is crucial to ensure that employees receive the correct pay and entitlements promptly. One way to achieve this is by providing visiting employee payslips.

These payslips serve as a record of an employee’s salary, deductions, and other benefits.

What is a Visiting Employee Payslip?

A visiting employee payslip is a document that employers provide to their visiting employees as a record of their salary and entitlements. It contains detailed information about the employee’s earnings, deductions, and any additional benefits they may be entitled to.

The payslip serves as proof of payment and helps employees keep track of their financial records.

Why are Visiting Employee Payslips Important?

visiting employee payslips are important for several reasons:

- Ensuring accuracy: Payslips help ensure that employees receive the correct amount of pay and entitlements. By providing a detailed breakdown of earnings and deductions, payslips help prevent errors or discrepancies in salary calculations.

- Compliance with labor laws: Many countries have labor laws that require employers to provide payslips to their employees. Failure to comply with these regulations can result in legal consequences for the employer.

- Transparency and trust: By providing payslips, employers demonstrate transparency and build trust with their employees. It shows that the employer values their employees’ financial well-being and respects their right to know how their salary is calculated.

- Financial record keeping: Payslips serve as a valuable financial record for employees. They can use payslips for various purposes, such as applying for loans, filing taxes, or tracking their income and deductions.

How to Create a Visiting Employee Payslip

Creating a visiting employee payslip involves several steps:

- Gather employee information: Collect all the necessary information about the visiting employee, including their full name, employee ID, designation, and department.

- Calculate earnings: Calculate the employee’s gross earnings for the pay period. This includes their regular salary, overtime pay, bonuses, or any other additional income they may be entitled to.

- Deduct taxes and contributions: Deduct any applicable taxes, social security contributions, health insurance premiums, or other deductions from the employee’s gross earnings.

- Include other benefits: If the employee is entitled to any additional benefits, such as paid leave, reimbursement of expenses, or retirement contributions, include them in the payslip.

- Provide a detailed breakdown: Ensure that the payslip provides a clear and detailed breakdown of each component, including the amount and calculation method.

- Format and design: Choose a professional and user-friendly format for the payslip. Include the company logo, employee details, and a clear summary of earnings, deductions, and net pay.

- Review and verify: Double-check all the information on the payslip for accuracy. Ensure that the amounts are correct and that the payslip complies with any relevant labor laws.

- Distribute the payslips: Print the payslips and distribute them to the visiting employees. Alternatively, you can also provide them in electronic format, such as PDF, via email or a secure employee portal.

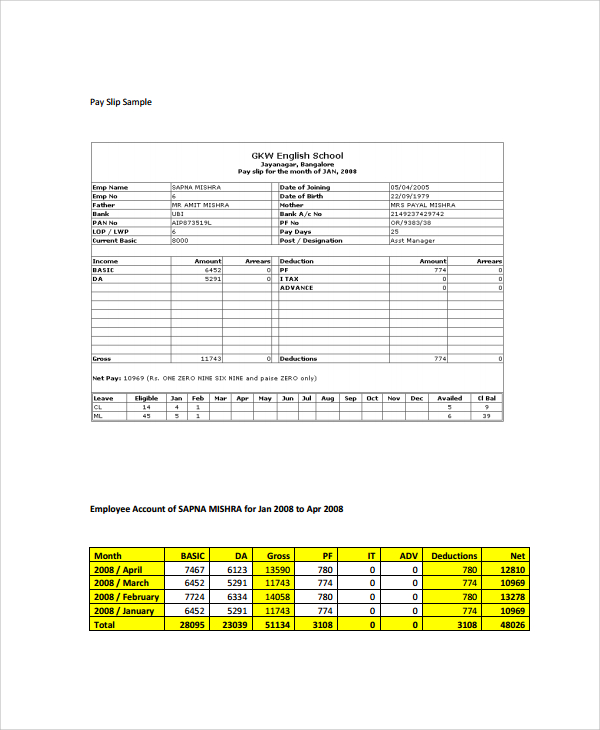

Examples of a Visiting Employee Payslip

Here are some layouts of a visiting employee payslip:

Tips for Successful Visiting Employee Payslips

Here are some tips to ensure the successful implementation of visiting employee payslips:

- Stay updated with labor laws: Familiarize yourself with the labor laws and regulations regarding payslips in your jurisdiction. Ensure that your payslip format complies with the legal requirements.

- Maintain confidentiality: Protect employee privacy by ensuring that payslips are securely distributed and stored. Avoid displaying sensitive information, such as bank account details, on the payslip.

- Provide explanations: Include brief explanations or definitions of terms used in the payslip to help employees understand the components and calculations.

- Offer digital options: Consider providing electronic payslips in addition to printed ones. This allows employees to access their payslips conveniently and reduces paper waste.

- Seek feedback: Regularly seek feedback from employees regarding the clarity and usefulness of the payslips. This will help you identify any areas for improvement.

Conclusion

A visiting employee payslip is a valuable tool for ensuring that employees receive the correct pay and entitlements. It serves as proof of payment, helps maintain compliance with labor laws, and supports financial record keeping.

By following the steps outlined above and implementing best practices, employers can create effective and user-friendly payslips that benefit both the organization and its employees.

Visiting Employee Payslip Template – Download